Uri Keren

Q&A With Uri Keren, CRO at Click-Ins

- What does Click-ins do?

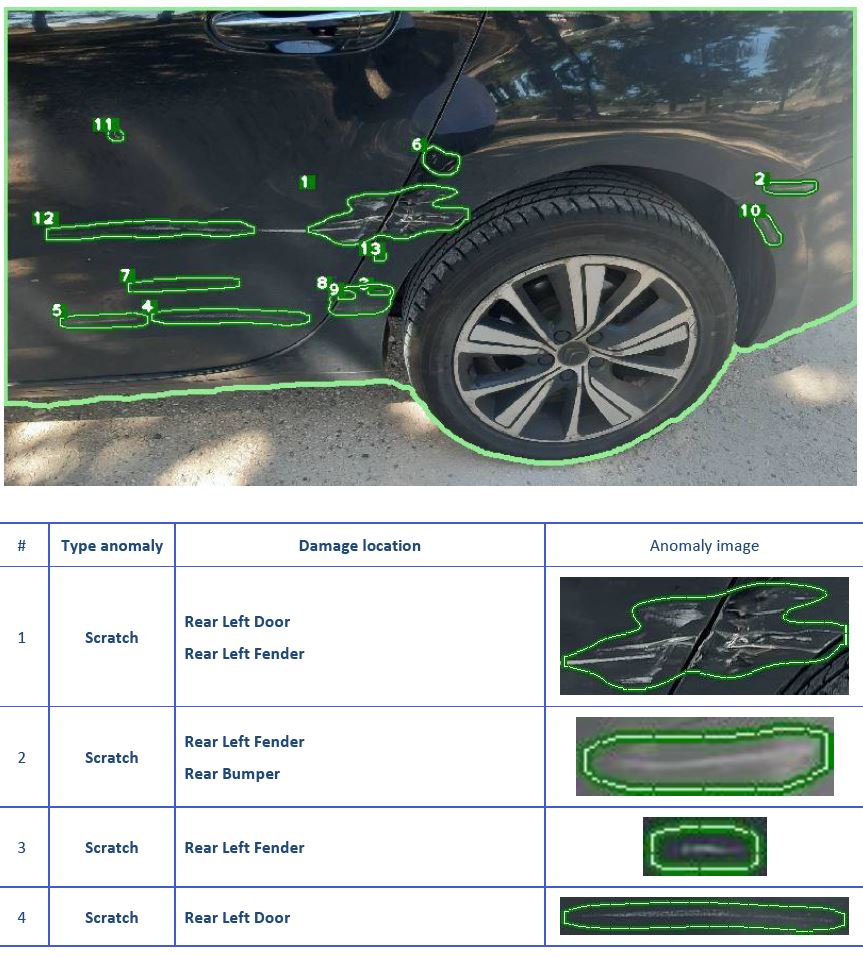

Keren: Click-Ins is the next-generation AI automatic vehicle damage inspection solution that enables insurance and car companies to automatically detect, analyze and process external vehicle damage, at high precision and consistency, without the need for special equipment or skilled personnel. We already work with the leading insurance, car rental, car share and car fleet companies, helping them to reduce touchpoints, automate decisions, reduce fraud & risk, and increase customers’ satisfaction.

Click-Ins Hybrid AI technology is based on a multidisciplinary approach which combines our unique capability to pre-train our own modules using our proprietary own simulated data/ Synthetic data, deep learning, photogrammetry, 3D modeling, applied mathematics, and computer vision to identify and analyze car damage with just a click of any digital camera.

- What sectors are you currently working with?

Keren: Our technology is being used in multiple sectors ranging from insurance, car rental, car share and car fleet companies. We are also looking into the aftersales and aftermarket segments.

- How can you make sure the images are in a good enough quality?

Keren: Our technology processes images in near-real time, thus allowing us to guide employees and consumers to take high quality pictures and in a standard procedure. Our technology guarantees that pictures are created at the right quality and contain the needed content for automated damage detection to succeed at high accuracy, without the need for special cameras or special training. Mobile camera is what it takes.

- How does your technology help insurance companies?

Keren: Automation is the future. For insurance companies, this means touchless claims and smart underwriting, which can only be made possible through reliable automation. Click-Ins™ unique Hybrid AI technology performs automatic vehicle inspections with an unprecedented level of

accuracy and consistency, so insurers can be certain of a vehicles’ exact condition, throughout its lifecycle. This level of transparency supports new business initiatives, taking insurance companies one step closer to their goal of automating processes and reducing touchpoints, risk, and loss, while preventing fraud and improving user experience. Click-Ins platform is pre-integrated with additional value-added solutions such as Telematics, FNOL, Document Authentication, Cost Estimation, and Claims Management platform, to provide our customers end-to-end automation.

- On what stages on the insurance purchase do you fit in?

Keren: We provide value to insurance companies, starting from the sales process, underwriting, claims, and to the customer journey:

For underwriting, insurers assess the current car condition to manage their risk and reduce loss ratio and at the same time prepare a pre-existing damage report.

For claim management, consumers report accidents using Click-Ins technology that allows capturing all damages, prevent fraudulent activities, and provide real-time guidance and information to the policy holders at the point of the FNOL. Claims managers receive information about the claim that allows them to make smart decisions, automate processes, reduce time and cost of claims settlement and process only new damages.

- How can the company translate the data to financial estimation of the damage?

Click-Ins partnered and integrated with the leading car damage cost repair estimation platform, allowing us to provide a fully automated solution of damage detection to cost repair estimation in over 30 countries.

- What companies are you currently working with?

Keren: We are working with numerous companies throughout the world, including but not limited to Sixt, Avis, Spearhead, GTMotive, Attestiv, Sapiens, Claim Technology, and Tata Consulting Services (TCS).

- How was the company affected by COVID-19?

Keren: COVID-19 has created a major demand and need for automation. Existing processes are human intensive, expensive, complex and long. The industry is searching for touchless solutions and relying more on AI-based solutions for automation of decisions and processes.

- What investments were made in the company so dar?

Keren: Click-Ins has raised $7 million dollars from VCs and strategic angel investors.

- What internal changes were recently made in the company?

Keren: We have doubled our team in the last quarter, hiring marketing, product, sales and programmers to support our growth.

- Tell me about your professional background.

Keren: I joined Click-Ins in July 2020 bringing extensive experience in product, technology & business management, working with multinational and startup companies to build and implement their product and business strategies. I hold a bachelor degree in Computer Science from the Technion in Israel.

At click-Ins we are building and implementing our global growth strategy. We are implementing innovative SaaS business models, marketing and sales strategies, and together with a winning product we are positioning Click-Ins as a market leader.