In this edition of our series on the Israeli Insurtech delegation heading to ITC Vegas in October 2024, we’re excited to showcase the forward-thinking companies transforming the insurance industry. This time, we turn our spotlight to Amplifair, exploring their journey, challenges, and groundbreaking technologies through detailed interviews.

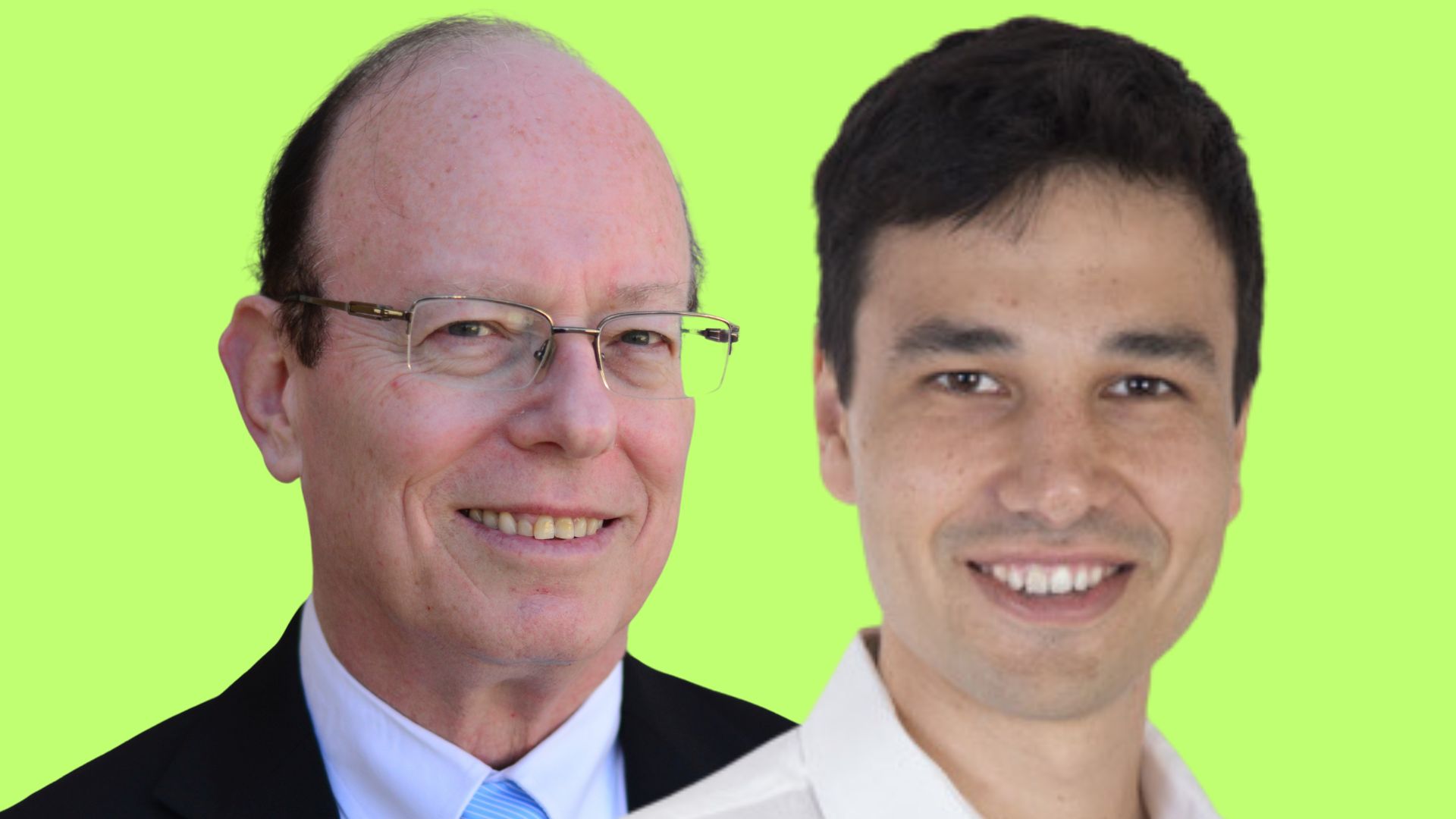

Amplifair’s Leadership Team

Company Overview

Can you briefly describe your company and its mission?

Amplifair: Our mission is to help enterprises get automatic visibility and control over hidden risk, sales, and churn trends, and so significantly improve their profitability and market share. I was inspired to do that when understanding that any AI model accuracy can be improved by using granular segmentation, with great impact attained in risk models.

The core technology of amplifair™ is what makes it possible to use it in many ways and a plethora of applications. While we do not plan initially to cover them all, we do have our sights set high and believe that we will be providing this solution not only throughout the Insurtech industry but also in many adjacent industries and beyond. You should expect much exciting news from us.

Product and Innovation

What sets your main product apart from existing market solutions, and what unique features or innovations does it offer?

Amplifair: we provide a data analytics platform that significantly improves financial decisions and profitability. Our AI layer provides visibility into hidden segments that directly affect your risk, retention, and customer acquisition results, giving you control over profitability and market growth.

We work with insurance carriers, MGAs, and Insurtech companies, in the P&C, health, and life sectors – one of which is AIG®. There we have reduced car and home portfolios loss-ratio by 10% and increased their customer retention rates.

Our customers experience tremendous success because it takes only 4 weeks to provide in-production results, using anonymized data without requiring replacement of existing infrastructure. All our findings are fully explainable and presented as a set of rules that can be instantly utilized on top of our customers’ existing systems.

Market and Problem-Solving

What specific problem does your solution address in the insurance industry, and who are your target customers and how do you reach them?

Amplifair: Insurance business line managers frequently need to make strategic changes in their portfolio to achieve target profitability. However, no automatic solution exists to identify loss-causing trends in existing portfolios. So, managers make decisions based on manual analytics procedures performed on Excel or BI platforms that have a shallow analysis depth, and by the time the analytics is ready it is usually too late, and the organization has lost tens of millions of dollars.

We target Property and Casualty carriers, both private and commercial lines, and address issues of risk, renewal rate, and conversion rate, by uniquely identifying those hidden segments, which typically are non-obvious. Simply put, we provide our customers with precise insights into unnoticed profit opportunities. We have already helped one of our clients improve their home insurance loss ratio by 10% points.

Our product is already deployed with several US based insurance companies, whom we reached in cooperation with consultancy companies, like KPMG, our investors’ network and Insurtech events like ITC.

Business Challenges and Solutions

What are the main challenges you have faced so far, and how have you overcome them?

Amplifair: When we formed our startup, the main obstacle was to get the carriers’ attention. Insurance companies are approached by many different companies, big and small. To overcome that overflow we emphasize how quick and efficient the proof-of-concept cycle is and the huge impact of our system on their profitability (10% improvement in loss ratio on average).

Explaining our insights to business stakeholders necessitated a steep learning curve on how insurance companies think about risk and market share. Once we understood that, we added dedicated flows and email notifications that promptly and intuitively explain the impact of our segmentation.

We were able to overcome these challenges because I have an excellent group of employees, investors, and a great board that challenges me on one hand and supports me on the other hand. It is a small but exquisite A-team that makes it all happen.

Current Status and Future Plans

What is the current status of your business, including development stage, revenue, and user base, and what are your key milestones and plans for the next 12 months?

Amplifair: Our amplifair AI layer works in production environments of paying US customers. We continuously strive to add automation features that enhance coverage and customer experience.

Our next release will allow stakeholders to compare their pricing structure to their competitors with a single click. Our market research shows that managers need to know how their competitors handle similar segments, so new underwriting adjustments would have the greatest impact on profitability.

Goals for ITC Conference

What are your primary objectives for attending the ITC conference, and are there specific partnerships or opportunities you are aiming to explore?

Amplifair: we have two primary goals for the ITC conference: clients and investors. I am planning to expose the amplifair™ platform to as many potential clients as possible, making them aware of the opportunities this platform offers. I will strive to schedule proof-of-concept trials with them. In addition, as I am working on our next round of investment, I will be seeking our next level investors. I will share with them my vision for the company and what it can achieve within a mere few years from now.

Team and Culture

Can you introduce your founding team, their backgrounds, and how their expertise contributes to the company’s success, including insights into your startup’s culture?

Amplifair: That is my greatest pride and pleasure. I am the CEO of the company, and my name is Bar Tsoury. I am a computer graduate and hold an MBA and worked for both large public companies as well as startup companies before founding this company. The founding team consists of serial entrepreneurs and successful investors such as Dani Krubiner and Reuven Marko. I strive to foster a team culture that is agile, flexible, respectful and success driven.

Funding and Investment

Have you secured any funding so far, and are you currently seeking additional investment? If so, how much are you looking for, and what will it be used for?

Amplifair: We have the backing of a group of angel investors, including Dani Krubiner and Dr. Giora Yaron, as well as TAU Ventures. We have just closed another round prior to the conference and will be working on fundraising starting at the beginning of next year. With that said, my board is open to raising additional funds in the interim. Such additional funding will allow us to hire additional personnel, sales and marketing, to reach our exciting sales goals, as well as developers to enhance and grow our product offering.

Industry Insights and Trends

What major trends or changes do you foresee in the insurtech industry over the next 5 years?

Amplifair: we believe that sophisticated technology will be the name of the game and no serious player will remain with only traditional infrastructure that is not enhanced by a variety of AI-based products. With that said, the issue is adoption on one hand and integration on the other. Adoption by professionals is always a challenge and they, also challenged by the regulatory environment, need support from the upcoming technological solutions. The integration into existing infrastructure rather than replacement of what people are accustomed to, is a challenge that must be solved. We at amplifair™ handle one aspect of this and are planning to grow and cover a breadth of solutions that can take advantage of legacy, modern and futuristic infrastructure. This is achieved by being infrastructure agnostic and an agile solution for identification and explanation of hidden segments.

Unique Selling Proposition

What is one thing you want potential customers or partners to remember about your company?

Amplifair: we would like business line managers to remember that we provide the only product that can significantly help improve profitability in a 4-week period using automatic insights into loss-causing segments.