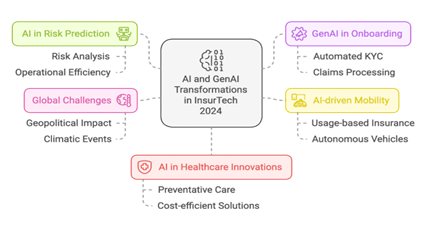

As we reflect on 2024, the InsurTech sector has witnessed remarkable evolution and innovation. Leaders from pioneering startups have shared their key insights and learnings that are reshaping the insurance landscape. From breakthrough technological implementations to novel business models, these perspectives offer valuable insights into the industry’s transformation.

Kobi Bendelak, CEO of InsurTech Israel said .””The year 2024 has been nothing short of extraordinary for the Israeli InsurTech ecosystem, showcasing unprecedented growth, innovation, and global recognition. Reading the reflections of these brilliant CEOs is truly inspiring, as they highlight the groundbreaking achievements of their startups and their ambitious visions for 2025. It fills me with immense pride to see how our ecosystem continues to flourish, driven by relentless creativity, technological advancement, and collaboration. I’m delighted that we had the opportunity to produce this fascinating document together with VOOM Insurance.

Amir Shneider Head Of Marketing at VOOM As we look back on 2024, said Israeli InsurTech ecosystem has proven itself to be a global powerhouse of innovation and resilience. In collaboration with InsurTech Israel, we had the privilege of engaging with some of the industry’s top leaders to uncover the trends that shaped this remarkable year .

From advancements in AI-driven underwriting to the expansion of usage-based insurance models, 2024 has been a year of transformation, paving the way for a more efficient, customer-centric insurance landscape. On behalf of VOOM, I want to thank the InsurTech Israel community for fostering such a vibrant ecosystem and extend a special thanks to Kobi for providing us with this incredible platform to share and celebrate our collective achievements.

Eliron Ekstein

Risk Prediction was notably leveraged by AI

Eliron Ekstein, Co-Founder & CEO, Ravin AI

“In 2024, The InsurTech industry has risen to the challenge of providing applications that harness the new powers of AI to meet practical industry challenges. First and foremost, risk prediction and analysis, but also customer service excellence and operational cost management – anything from smarter ways to handle claims, to customer-facing tools that allow rapid self service”

GenAI is streamlining onboarding and enhancing claims management

Dvir Ginzburg

Dvir Ginzburg,CEO, Insait.io: “The insurance sector is transforming as companies recognize GenAI’s potential to simplify complexity and drive value. GenAI is streamlining onboarding, automating KYC, and enhancing claims management with intelligent processing, fraud detection, and predictive analytics, improving efficiency and customer experience. Insurers are also leveraging GenAI for personalized recommendations and targeted cross-selling, boosting retention and revenue. Insait leads this shift with a GenAI-based digital agent that automates processes and transforms websites into conversational platforms. Delivering results like a 30% increase in conversion rates and a 45% reduction in operational costs, Insanity helps insurers simplify operations, engage clients, and unlock new opportunities”.

Tomer Kashi

AI-driven mobility reshapes the industry

Tomer Kashi, Co-Founder & CEO, VOOM Insurance

“In 2024, we witnessed the rapid adoption of new mobility segments, particularly at the intersection of connectivity and AI, which is set to transform the insurance industry. From the widespread implementation of usage-based insurance (UBI) to the increasing presence of autonomous vehicles like Waymo operating in major cities, these advancements underscore the need for innovative, data-driven insurance solutions that can keep pace with evolving risks and opportunities in mobility.

Global Challenges Reshape the Insurance Landscape

Oran Atia

Oran Atia,CEO, Seenity: “In 2024, an important trend we observed this year is the increasing impact of geopolitical and climatic events. These factors are particularly significant for insurance companies, especially in their interactions with reinsurers. As a result, the process of assessing risk for an entire insurance portfolio in relation to the environment in which the company operates has become critical in 2024. Looking ahead, The intersection of advanced technologies and the pressing The realities of global events makes this an especially pivotal moment for the industry”.

InsurTech prioritizes AI-driven healthcare innovations

Shlomit Steinberg Koch

Shlomit Steinberg Koch, Co-Founder and CEO, Predicta Med

“In 2024, the InsurTech industry prioritized preventative care and cost-efficient solutions, fueled by AI-powered tools and data-driven insights. Companies like Predicta Med empowered healthcare providers to detect immune-related diseases earlier, improve patient care, and reduce unnecessary expenditures. Predicta Med’s decision support platform integrates seamlessly with EMRs, leveraging machine learning and LLMs to identify patients likely to have undiagnosed immune-related conditions and provides cutting edge tools to optimize intervention and treatment of these conditions. This platform enables efficient, cost-effective actions aligned with insurers’ goals of reducing costs and enhancing outcomes. This innovation highlights how InsurTech is reshaping care pathways and advancing value-based care”.

AI’s Transformative Impact in 2024

As demonstrated by the leaders’ insights, AI has proven essential in helping insurers navigate complex risk landscapes while simultaneously improving operational efficiency and customer engagement. The technology has enabled insurers to address traditional challenges in novel ways while opening new opportunities for growth and innovation.

Amit Nisenbaum

Amit Nisenbaum Co-Founder and CEO,:

Comparing 2024 to the previous years while running a specialized lines MGA it is clear to me that one of the key trends in Insurance in general and as related to new entrants (full stack carriers and MGAs/MGUs alike) is the focus on profitability. The days of chasing growth at any means, even at the expense of profitability, not to say positive cashflow, are long gone. This is one symptom of a much deeper phenomenon of “getting back to basics”. It is now the era of insurance companies using technology to differentiate vs. the previous era of tech companies underestimating the rigor, skills, and best practices needed to run a long-lasting insurance company