OKO, a pioneering ClimateTech and AgriTech company providing climate insurance for agricultural value chains in Africa, today announced it has secured a six-digit funding round led by Catalyst Fund, with participation from two existing investors.

This new capital will accelerate OKO’s commercial growth – already active in several multi-country partnerships with financial institutions and agro-industries – and reinforce its mission to build economic resilience for millions of African farmers facing climate shocks. The announcement follows OKO’s selection as one of 22 African startups in the fourth cohort of the Visa Africa Fintech Accelerator Program. With operations spanning Côte d’Ivoire, Mali, Uganda, Mozambique and Angola, OKO has already protected more than 33,000 farmers and executed all validated claim payments, strengthening trust among partners and insured farmers. The company will use the funding to deepen partnerships with financial institutions, agritechs and agro-industries, embedding automated climate insurance into agricultural value chains and helping partners de-risk their activities in the face of escalating climate change challenges.

“With climate volatility intensifying across Africa, insurance is no longer optional, it’s essential. We are incredibly proud to have Catalyst Fund lead this round. Their mission-oriented approach and deep expertise in impact ventures and climate resilience align perfectly with our own vision,” said Simon Schwall, CEO of OKO. “This investment is a strong validation of our achievements so far and of our commitment to making climate insurance and other resilience tools accessible to both small and large businesses in Sub-Saharan Africa. With this new support, and by drawing on leading sector advisors, we are ready to expand our reach and enable partners to better serve their farmers with data-driven climate risk management solutions.”

Catalyst Fund’s investment rationale centers on OKO’s innovative approach and its potential to scale a proven model that helps close the climate protection gap for both commercial and smallholder farmers. “The imperative to build a more resilient and inclusive financial system is at the core of our work,” said Maxime Bayen, Operating Partner at Catalyst Fund. “OKO’s technology provides a powerful solution to a pressing global problem, and we believe their platform is a game-changer for financial institutions and agribusinesses seeking to mitigate risk while supporting the agricultural backbone of Africa.”

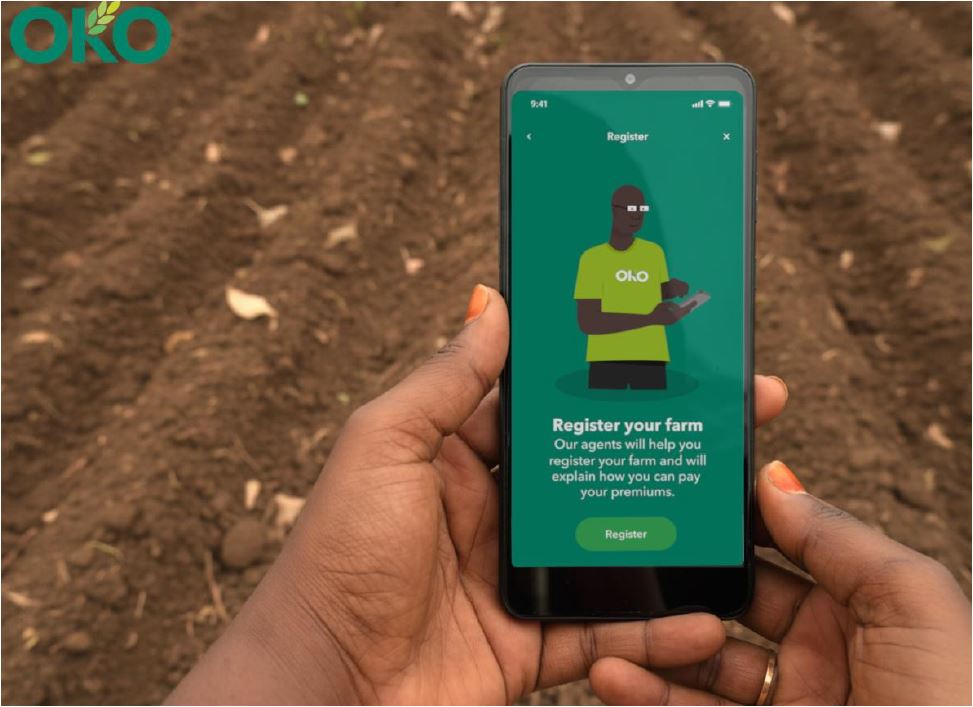

About OKO OKO is a ClimateTech and AgriTech company that uses satellite data and mobile technology to provide affordable and accessible crop insurance for agricultural value chains. By partnering with financial institutions and agribusinesses, OKO helps de-risk agricultural financing, build economic resilience, enables farmers to cope with climate risks and build climate-resilient supply chains. OKO currently offers insurance products in 5 countries: Ivory Coast, Mali, Uganda, Mozambique and Angola. For more information, visit www.oko.finance.

About Catalyst Fund The Catalyst Fund model delivers outsized success compared with other accelerator programs. We accelerate startups that excel on three fronts: Impact: Catalyst Fund startups deliver (or, in the case of B2B firms, facilitate the delivery of) life-changing products and services to underserved populations. These can include financial services like loans, savings, insurance, and investment, but also access to productive inputs or essential services such as energy, sanitation, and water.

Innovation: Our startups are pioneering game-changers that are innovating new products and business models. They drive the sector forward by demonstration effect and via the learning that Catalyst Fund documents and shares.

Growth potential: Catalyst Fund startups are distinctively investment-worthy, developing businesses that are scalable, with high growth potential. Our startups raise more funding than startups from other accelerators.