Earnix, a leading global provider of intelligent Artificial Intelligence (AI) driven decisioning solutions for insurance, and KPMG in France, a leading audit and advisory firm, today announced they have entered into a strategic partnership to deliver a more comprehensive and valuable pricing platform and actuarial consulting services to clients in the French Insurance market. By integrating Earnix’s innovative analytics with KPMG’s robust delivery framework and complete service offers in the Insurance sector, the partnership’s main goal is to deliver superior client outcomes through improved product development, pricing optimization and pricing process fluidification from product development to underwriting. Using Earnix’s advanced…

Browsing: #featured

iA Financial Group, one of Canada’s largest life insurers and a leader in wealth management, is proud to announce a strategic partnership with Empathy, the technology company transforming how families navigate life’s most difficult moments. Beginning in Spring 2026, Canadian beneficiaries of iA’s Individual Life products will gain access to Empathy’s award-winning Loss Support solution—an innovative blend of advanced technology and human-first care designed to provide emotional, logistical, and administrative assistance during bereavement. “At iA, every decision starts with the client. This partnership reinforces our belief that insurance is more than financial protection—it’s about standing beside families when they need…

The global insurance industry is undergoing one of the most significant transformations in its history. Once known for legacy systems, complex onboarding processes, and slow product cycles, today’s insurers are accelerating toward a fully digital, data-driven future. At the centre of this evolution stands AI which is rapidly moving from experimentation to a core strategic capability for insurers worldwide. From Automation to Intelligence: The New Foundations of Insurance AI is no longer limited to chatbots or back-office automation. Insurers are now embedding AI into the entire insurance value chain — underwriting, pricing, distribution, claims, fraud detection, and customer service. The…

A legitimate-looking invoice. A photo of damage. A claim submitted through a trusted channel. Everything checked out, until it didn’t. The repair shop didn’t exist, and the documents were expertly fabricated. No complex ring or career criminal here, just a regular policyholder using off-the-shelf AI tools. Fraud’s New Face Insurance fraud remains one of the industry’s biggest drains, costing hundreds of billions annually.[1] But the AI revolution is reshaping the landscape, empowering fraudsters with tools that make schemes easier to execute and harder to detect. From fabricated claims to synthetic identities, insurers are seeing a sharp rise in fast-evolving threats.…

Honeycomb Insurance, the digital MGA specializing in tailored property and casualty coverage for landlords and condominium associations, announced today that it has begun writing policies in Colorado, one of the most challenging insurance markets in the country, bringing needed stability and optionality to its 20th state. Colorado agents and brokers have been facing shrinking eligibility and limited carrier options for years. Many admitted carriers have pulled back or tightened their appetite, leaving well-maintained properties (especially those built before 1990) with few viable options or none at all. At the same time, agents report more non-renewals than new placements, with wind…

In a move set to accelerate AI adoption in the insurance industry, Five Sigma, the AI claims technology company behind Clive™, the industry’s first Multi-Agent AI Claims Expert, and Sutherland – a global business and digital transformation company, announced a strategic partnership designed to reshape the way insurers handle claims, from first notice of loss to final settlement. The partnership combines Five Sigma’s Claims Management AI and automation technology with Sutherland’s AI-native digital engineering and Business Process-as-a-Service (BPaaS) expertise, creating a powerful combination that accelerates insurers’ AI transformation journey from strategy to execution. Together, the companies aim to offer insurers a comprehensive, front-to-back…

Surense and The Phoenix have launched a new end-to-end digital process for issuing Phoenix Invest policies—directly from Surense’s CRM for insurance agents. In what the companies describe as a first-of-its-kind collaboration in Israel, agents can now generate a full investment policy within minutes, instead of days, straight from the customer record in Surense.Previously, issuing a policy required filling and sending forms through the agent’s sales systems, including manual data entry and multiple approvals. With the new Surense integration, the flow opens inside the Surense client file, pre-populates most required fields, and applies built-in validations to reduce rejection rates. At the…

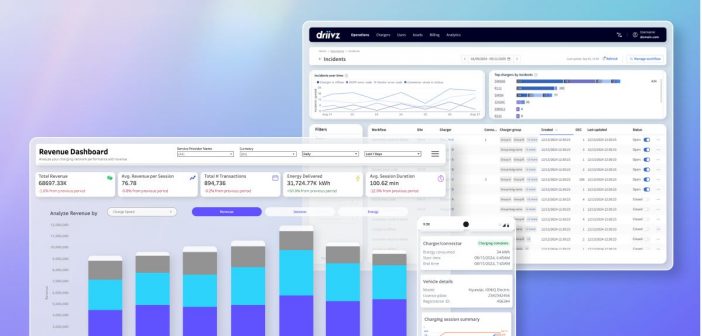

Driivz, a Vontier (NYSE: VNT) company and leading global software supplier to EV charging operators and service providers, today announced the release of the latest version of its electric vehicle (EV) charging and energy management software platform. The Driivz Platform Version 9 is available to Driivz customers, currently operating in over 30 countries across North America, Europe and APAC, and will be an invaluable resource for EV charging networks seeking to provide reliable charging while achieving energy resilience. The built-to-scale Platform V9 arms EV charging providers with data-driven actionable insights, network optimization tools and new smart energy management solutions, designed to streamline…

CoreTrust, a leading Cooperative Purchasing Organization (CPO) trusted by thousands of organizations, today announced that Healthee has joined as an awarded supplier within the CoreTrust Public Sector Cooperative, marking the company’s continued expansion within the public sector. Through this partnership, CoreTrust members now have direct, compliant access to Healthee’s AI-powered benefits navigation platform via pre-negotiated cooperative contracts, effectively eliminating lengthy RFP cycles and enabling immediate deployment for state and local agencies. With the current administration placing renewed emphasis on government efficiency and spending accountability, agencies nationwide are under increasing pressure to eliminate waste, modernize operations, and do more with limited resources. This…

MP Check, an insurtech company specializing in medical examinations for insurance underwriting, is introducing a new feature in its medical survey platform: an advanced artificial intelligence (AI) model for summarizing medical data. According to the company, the new model can analyze and synthesize all clinical information gathered during the medical screening process—from the health declaration through to the medical test results performed by MP Check teams at the customer’s home or office. Using smart algorithms, the system generates a structured, comprehensive, and clear medical report for the company’s physicians, providing a full and accurate clinical picture of the insured’s condition.…