Earnix, a leading global provider of intelligent decisioning SaaS solutions for financial services, is pleased to announce its membership with the Managing General Agents’ Association (MGAA) as a Supplier Member. The MGAA is a prominent association representing over 400 Managing General Agents (MGAs) across the UK and the Republic of Ireland. As part of this vibrant and fast-growing community, Earnix is excited to support the innovation and growth of MGAs with its advanced technology solutions. The MGAA’s mission focuses on providing its members with networking and education opportunities, advocating on behalf of MGAs in the industry, and addressing key issues such as…

Browsing: #featured

Jones, a startup offering an AI-driven insurance risk management system for the real estate and construction sectors, has completed a $15 million Series B funding round led by NewSpring Capital. The round also saw participation from existing investors: Hetz Ventures, JLL Spark, Camber Creek, Khosla Ventures, DivcoWest Ventures, Rubin Ventures, and GroundUp Ventures. To date, Jones has raised a total of approximately $40 million since its founding. Jones was established in 2017 by Omri Stern, a Harvard Business School graduate, and Michael Rudman, a graduate of Israel’s Talpiot program. The company’s platform provides real estate firms with full automation for…

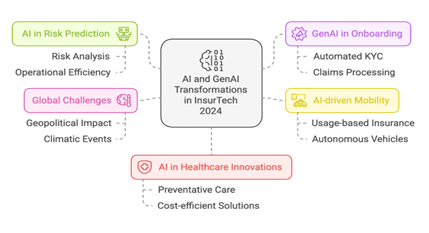

Key Trends in 2024: In 2024, artificial intelligence emerged as a dominant force, driving significant digital transformation within the insurance industry. A strong focus on climate solutions and sustainability emerged alongside a wave of new regulations that presented both challenges and exciting opportunities for insurance companies. Research data revealed a 25% increase in the adoption of advanced technological solutions within the Israeli insurance market. The integration of diverse technological fields, including Climatetech, Agetech, Spacetech, and Healtech, fostered groundbreaking collaborations and expanded the range of technologies applicable to the insurance sector. These advancements position Israel at the forefront of global development,…

MediMe is proud to announce an exciting new collaboration with Direct Insurance. Starting January 2025, MediMe will launch a pilot program utilizing its cutting-edge AI technology to revolutionize health insurance processes. The groundbreaking technology developed by MediMe enables fast and precise analysis of health insurance policies, personalized solutions tailored to individual customers, and a significant enhancement in addressing policyholders’ needs. This partnership is part of Direct Insurance’s forward-thinking innovation strategy, led by the company’s VP Technology & Innovation , Raz Bartov, and Head of Development & Innovation, Heli Mirel. “We are thrilled and honored to be part of the insurance…

bolttech, the fast-growing global insurtech, today announced Dragon Fund, by Liquidity and MUFG, is leading bolttech’s Series C funding round alongside investors Baillie Gifford, Generali – through Lion River, the Group’s company dedicated to Private Equity, and others, which is expected to total more than US$100 million. Following bolttech’s record-breaking Series A and B rounds, the Series C up-round values bolttech at US$2.1 billion and the investment will further enhance its global growth strategy. The strategic support of lead investor Dragon Fund alongside the follow-on investors and the Series C funding will enable bolttech to continue to enhance its platform’s capabilities,…

The year 2024 was transformative for the Israeli InsurTech ecosystem, positioning the nation as a leader in insurance innovation. With eleven Israeli startups featured in CNBC’s prestigious “World’s Top 150 InsurTech Companies,” the year showcased groundbreaking achievements in funding, acquisitions, and global collaborations. As we prepare to release a comprehensive report summarizing 2024 and projecting trends for 2025, this article highlights the key investments and milestones that defined the past year. Q1 2024: A Strong Start with a Total of $324M The year began with significant advancements in retirement, healthcare, and small business insurance: Next Insurance raised an impressive $265…

As we reflect on 2024, the InsurTech sector has witnessed remarkable evolution and innovation. Leaders from pioneering startups have shared their key insights and learnings that are reshaping the insurance landscape. From breakthrough technological implementations to novel business models, these perspectives offer valuable insights into the industry’s transformation. Kobi Bendelak, CEO of InsurTech Israel said .””The year 2024 has been nothing short of extraordinary for the Israeli InsurTech ecosystem, showcasing unprecedented growth, innovation, and global recognition. Reading the reflections of these brilliant CEOs is truly inspiring, as they highlight the groundbreaking achievements of their startups and their ambitious visions for…

Empathy partnered with Prudential Financial, one of the world’s leading insurance providers, to bring Empathy’s holistic bereavement support to millions of Prudential’s policyholders and their families. This partnership marks a significant step forward, not only for Empathy but for the entire compassionate economy that we’re leading to scale with holistic, tech-supported care. Prudential is renowned for its unwavering dedication to making lives better. For over 145 years, they’ve supported families with trusted financial services, keeping compassion at the heart of everything they do. With their far-reaching presence in the insurance industry and $1.45 trillion in AUM, they’ve built a legacy that…

CMiC, the leading provider of next generation construction ERP, has announced a strategic partnership with Jones, an insurance compliance software provider specializing in real estate and construction. This integration will deliver a robust solution to general contractors, empowering them to manage subcontractor compliance within CMiC without the need to navigate across multiple platforms. By integrating the Jones COI (Certificate of Insurance) automation capabilities into CMiC’s project management applications, users can now streamline subcontractor insurance verification and compliance, thereby, accelerating workflows and reducing risk. Jones, headquartered in New York City, provides cutting-edge software solutions that enable real estate and construction firms to…

Core insurance software solution provider, Fadata, and expert in business intelligence (BI), InsFocus, are teaming up to deliver cutting-edge Operational and Analytical BI solutions to insurers worldwide. Pre-integrated with Fadata’s core platform, INSIS, insurers will enjoy seamless access to the enhanced data management capabilities and advanced analytics delivered by InsFocus. InsFocus is developing a specialized extract-and-transform tool designed to integrate smoothly with INSIS, insurers will then benefit from a ready-to-use Operational BI solution and have the opportunity to add an advanced analytics layer designed to unlock deeper insights. Additionally, the partnership will offer Fadata customers a comprehensive Data Warehouse solution,…