Name of the Company: PureSight Technologies Ltd Describe the Company’s Core Activities: Providing AI-based online child safety services for parents that include practical tools for parents to use on a daily basis, such as: Social protection service that monitors all the conversations of the children on social platforms, like WhatsApp, Instagram, and TikTok, and detects and alerts parents on conversations that require parental involvement Such as cyberbullying, a pedophile that is trying to connect with the child or their exposed to inappropriate or harmful online trends. Content filtering service allows parent to block inappropriate web content from their kids, like…

Browsing: #featured

Name of the Company: OpenLegacy Describe the Company’s Core Activities: OpenLegacy offers a cloud-first legacy integration and modernization platform. OpenLegacy Hub delivers high ROI with a simple, disruption-free, method to generate, extend and manage digital services from legacy systems to the cloud. Jumpstart and optimize your modernization journey and follow it through, no matter the chosen strategy: modernizing in place (hybrid), rehosting/replatforming or even replacing and rewriting the entire application. Each can be simplified and automated to perfect the process drastically eliminating complexity, time, cost, and risk. OpenLegacy’s robust modernization platform is designed to address the painful challenges of complexity,…

Urbanico welcomes Peter Lynch as a new member to its Advisory Board. Peter is a global insurance advisor with over 30+ years of experience in the insurance industry. Peter previously served as an executive vice president at Transunion and led their global insurance product strategy. Previous roles included president of the LexisNexis Insurance Exchange as well as additional senior executive positions at LexisNexis Risk Solutions, ChoicePoint, AIG Technologies (AIGT), and Cover-All Technologies, all focused on insurance data, analytics and technology. Peter’s key understanding of data and analytics deployment throughout the insurance value-chain, from marketing through underwriting all the way to claims management,…

PALO ALTO, Calif., Oct. 5, 2023 /PRNewswire/ — SkyWatch, a leader in digital insurance for the aviation industry, is proud to announce the strategic acquisition of Droneinsurance.com’s assets. This collaboration brings together two innovative platforms, to offer clients a seamless experience with more options. It marks a significant milestone in the drone insurance sector and underlines SkyWatch’s commitment to providing unmatched coverage and service to drone operators across North America. Under the partnership, customers of Droneinsurance.com will now be seamlessly transitioned to the SkyWatch platform for their insurance needs. This move guarantees a smoother experience for Droneinsurance.com clients while opening up a new world of…

At-Bay, the insurance provider for the digital age, today announced that it has added more than 40 new classes of business to its Miscellaneous Professional Liability (MPL) product and increased the eligible revenue limit for businesses to $50 million. Boosting the number of business classes available within the six most popular verticals offered by At-Bay MPL, the industries represented span the likes of Real Estate, Education, Consulting and Financial Services, Media and Communication, Employment and Staffing, and Legal and Security Services. Leveraging At-Bay’s proprietary risk engine and advanced analytics capabilities to better assess and price risks for MPL with greater…

Name of the Company: Gabriel Describe the Company’s Core Activities: Gabriel’s next-generation security technology instantly detects and automates a response to violent threats before chaos sets in, saving precious time and lives. Through AI-based sensing, automatic alerts and instant visibility, Gabriel provides customers, their people and first responders the critical information and communication they need to take control. Insurers are now leveraging the power of Gabriel to protect their insureds, write smarter risk, and differentiate in the market. Gabriel’s intelligent learning software easily integrates all your existing devices to offer continuous precise mapping, reliable video and audio streaming even under…

Name of the Company: Pecan AI Describe the Company’s Core Activities: Pecan helps marketing, revenue, and data teams predict mission-critical outcomes. Our low-code platform puts the power of predictive machine learning models at their fingertips without requiring data scientists on staff. With Pecan’s secure platform, companies generate actionable predictions of customer lifetime value, retention, marketing efficiency, and more in just weeks. Founded in 2018, Pecan’s predictions impact billions of dollars in revenue for fintech, insurance, retail, CPG, mobile apps, and consumer services companies of all sizes. What Specific Challenges in the Insurance Sector Are You Addressing? Pecan AI’s ML-driven predictive analytics…

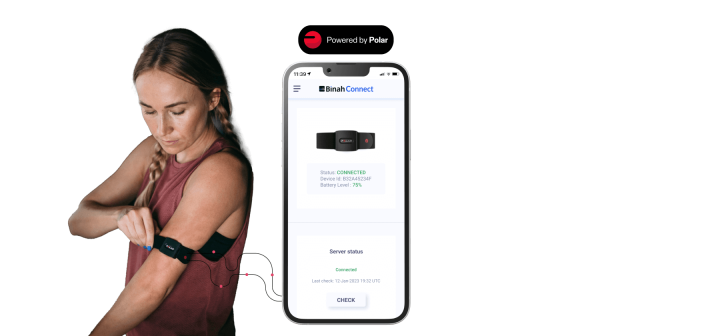

Tel Aviv Israel, September 20, 2023 – Binah.ai, the number one health and wellness check software, announced today its partnership with Polar Electro, the world leader in personal guidance for fitness, sport and health. Binah.ai’s award-winning, innovative technology, delivered to organizations as a Software Development Kit (Binah SDK), seamlessly integrates into apps or workflows to empower offerings with spot and continuous health and wellness checks that end-users can perform anytime, anywhere, by simply looking at the camera of a smartphone or tablet, or just by comfortably wearing a Polar Verity Sense™ optical heart rate sensor. With the combination of Binah.ai software and Polar Verity…

Earnix, the global provider of intelligent, composable, SaaS solutions for insurers and banks, announced Model Accelerator at Earnix Excelerate 2023. Model Accelerator is a web-based module designed to streamline and accelerate the process of building and incorporating advanced models in pricing, underwriting and real-time rating. One hundred percent of insurance leaders plan to use machine learning models in their pricing and underwriting processes, according to a 2023 study commissioned by Earnix1. However, only 20 percent of the survey’s 400 respondents said they do so today. Factors leading to slow adoption include difficulty importing external models; the iterative and manual processes…

There are many expectations from this developing insurance sector, given the growing need for cyber insurance protection as demonstrated by the significant damages caused to companies and organizations worldwide from cyber attacks as well as the evolving regulatory environment. At the moment, however, the cyber insurance field does not deliver on the expectations placed on it. Sales volumes are lower than expected, and the loss ratio is negative. Cyber insurance is not yet positioned as a central coverage for customers, and a significant portion of the premium is part of larger insurance coverage packages and not derived from stand-alone insurance.…