The policy was launched in Makeuni County, Kenya when Eunice Jesang paid $0.83 to insure her maize against crop failure The Lemonade Crypto Climate Coalition launched recently their first real life parametric insurance policy that’s done purely on the blockchain. Lemonade announced that The policy was launched in Makeuni County, Kenya when Eunice Jesang paid $0.83 to insure her maize against crop failure. Eunice is the first farmer to get covered by the Lemonade Crypto Climate Coalition. The coalition made of Avalanche, Chainlink Labs, PULA, Hannover Re, DAOstack and Etherisc.

Browsing: #featured

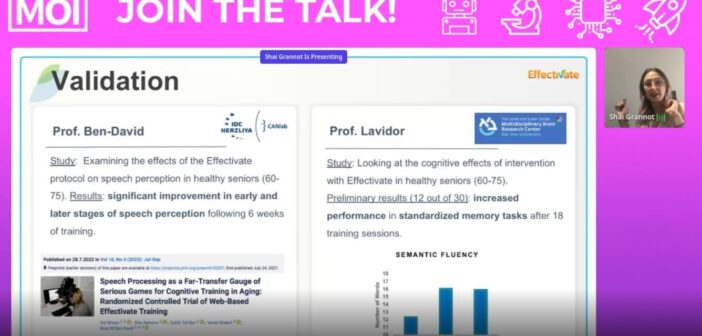

Effectivate’s founder, Shai Granot, together with the game architect Anna Izoutcheev, presented a keynote talk titled “Cognitive Training: Opportunities for Insurers in the World of Neuro-Wellness”. MOI 2022 conference is the biggest European gatherings for innovators in the realm of insurance Effectivate, an Israeli start-up that provides computerized cognitive training, participated in MOI 2022 – The Magic of Innovation conference, where the company had the opportunity to present its vision and accomplishments, and share some insights. The conference, held annually in Vienna, is one of the biggest European gatherings for innovators in the realm of insurance, allowing decision-makers in this field to learn…

Novidea, the creator of the cloud-native, data-driven insurance Agency Management System (AMS), today announced significant new enhancements to its low-code automation rules engine. These enhancements will empower independent agents, brokers, managing general agents (MGAs) and wholesalers to work smarter and more efficiently, while providing a great customer experience. Each insurance policy transaction involves multiple functions and processes that carry out specific tasks across an MGA’s or agency’s front, middle and back offices. Each of these tasks involves rules, regulations, and agency policies that drive decision-making for agents and their customers. Novidea’s newest system upgrade includes dynamic questionnaires based on the…

Michigan-based Agency Creates a Centralized System of Record to Improve Customer and Employee Experience Encore Insurance, a digital-native independent insurance agency specializing in personal lines, has selected Novidea’s cloud-native, data-driven agency management system (AMS) to scale and create a better customer experience. By putting real-time customer data at every employee’s fingertip, regardless of where they choose to work, Encore can now boost conversions, resolve customer disputes more quickly, and make better-informed business decisions. “As a modern, digital-first independent agency, we have a future goal to scale beyond Michigan and service clients across all 50 states. To accomplish this, we knew…

With it’s 30 startsups in the formal delegation, and over 40 companies at total (Out of about 400 Companies and startups from around the world) – the Israeli Insurtech got a lot of respect in the ITC2022 convention that took place last week in Las vegas. Israeli Market leaders such as Kobi Bendelak – CEO of Insurtech Israel, Gil Arazi – CEO of FinTLV, and many more, spoke on panels and presented their Views and Ideas About the current trends in the Insurance and Insurtech Sectors. Here are some of the Highlight Of the Israelis participants in the conference.

PlanetWatchers are delighted to announce we have raised $11M in series A funding to further support our ambitious growth plans. The funding raised will allow us to invest in our industry-leading SAR-based data analytics alongside expanding our team to address the increasing market demand to help solve global food security issues. This latest funding builds on our successful pre-series A round, which closed in June 2021 and means we can significantly increase our commercial footprint with crop insurers and agricultural input providers. For the reactions of our CEO, Dominic Edmunds, Andre Ronsoehr, Principal at Seraphim Space and Champ Suthipongchai, General…

Guidewire (NYSE: GWRE) and Ravin AI announced that Ravin has joined Guidewire PartnerConnect as a Solution partner. Ravin’s automated vehicle inspection tool enables non-professionals, like insurance customers, to capture the condition of a vehicle accurately. It leverages advanced computer vision and deep learning to analyze car damage and generate a 360-degree condition report or repair estimate. When completed, Ravin’s Ready for Guidewire integration will enable Guidewire users to access its vehicle inspection tool from within ClaimCenter, expediting and enhancing the vehicle inspection process. “Our technology was built from 360-degree vehicle scans from over half a billion organic images and includes…

Small businesses can now seamlessly bundle insurance policies and benefit from NEXT’s new state of the art workers’ compensation pay-as-you-go offering NEXT Insurance, a leading digital insurtech company transforming small business insurance, and Intuit Inc. ( Nasdaq: INTU), today announced the launch of NEXT Connect for Intuit QuickBooks, an embedded insurance solution that provides customers with seamless access to digital-first insurance products within the QuickBooks ecosystem. Small businesses and accountants can obtain insurance quotes and bind coverage without leaving their QuickBooks account. Additionally, users can benefit from NEXT’s technologically advanced, in-house pay-as-you-go offering for workers’ compensation, consult with a trusted insurance…

REACH is an all-in-one remote engagement platform created to enable banks, insurance agencies, financial institutions, and their clients, to complete multi-channel digital transactions in just minutes. REACH integrates seamlessly into the enterprise’s back-end systems and CRM’s, allowing document collaboration, uploading of documentation, e-signature, video conference, ID verification and payment processing on a single platform. Sessions can be conducted in real time, self-service mode, or a hybrid of both. REACH is reinventing remote business by providing an effortless way to conduct and close business. The key figures in the company are Yair Ravid – Co-Founder and CEO Koby Avitan – Chief…

The cyber insurance field has been attracting the attention of the insurance world for over a decade. There are many expectations from this developing insurance sector, given the growing need for insurance protections following the significant damages caused to companies and organizations worldwide from cyber-attacks as well as the evolving regulatory environment. At the moment, the cyber insurance field does not yet deliver on the expectations placed on it; sales volumes are lower than expected and the loss ratio is negative. In addition, cyber insurance has not yet positioned itself in the industry as a central coverage for customers and…