By virtue of its successful deployment in the US, INSHUR selects Five Sigma’s SaaS-based solution to build its in-house UK claims operations. Five Sigma, an emerging leader in cloud-native Claims Management Solutions (CMS), today announced that INSHUR has chosen Five Sigma’s CMS for its UK in-house claims operations. INSHUR is a leading global Insurtech firm in the embedded insurance space that has made a name for itself by providing an innovative, data-driven approach that sets a new benchmark for the development and distribution of commercial insurance products. This new implementation will allow INSHUR to extend that same quality, speed, and…

Browsing: #featured

Wesure says that receipt of the permits completes the additional pre-conditions of the Ayalon agreement, the completion date for the Ayalon acquisition is set for June 30 2022 The Wesure Globaltech technology and insurance company has announced that it is advancing towards completion of the deal for the acquisition of Ayalon. The company has reported that additional approvals have been received forming pre-conditions for execution of the deal. Amongst other things, the Capital Market Commissioner has granted control permits to Wesure’s controlling shareholders (Wesure founders Emil Weischel and Nitzan Tzair Harim and Tzvi and Anat Barak, the owners of Caesarea…

Medical care and travel startup Air Doctor has secured $20M in funding for scaling the company globally. This second round of investment capitalizes on the worldwide influx in travelers after the Covid-19 pandemic and will enable the company to enter its next phase of growth. Air Doctor, raised $20 million, led by Lightspeed Venture Partners. Joining this round are Vintage Investment Partners and Munich Re Ventures, alongside The Phoenix, one of Israel’s leading insurance providers, as well as Kamet Ventures, which led the company’s previous round. Founded by Jenny Cohen Derfler, Efrat Sagi Ofir, Yam Derfler and Yegor Kurbachev, Air…

Travel and health insurtech leader, PassportCard has been granted a US patent for its real-time claims payout through debit card which gives customers access to a global, 100% cashless insurance service. The patented technology, driven by AI, predictive analytics and a vast medical services database allows customers to facilitate automated, instant processing of insurance claims – without having to pay via their own funds and wait to be reimbursed. The system pre-emptively processes a claim, activating the dedicated debit card issued to the customer when they purchased the policy. Following treatment, the customer pays with their card or digital wallet,…

PureSight build tools for parents that could get indications of what was happening to their children on the digital platforms to allow parents to be involved in their children’s digital world Royi Cohen is the founder and CEO of PureSight. he founded PureSight back in 1998, right after graduating with honors from the Technion. According to Cohen, The technological base on which the company was based was an engine based on AI algorithms when their initial application was an engine for website classification. At this stage, the company focused on building products for enterprises that enable content filtering in the…

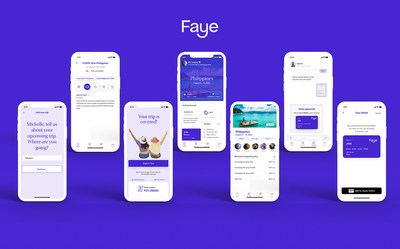

Coverage, care & claim filing made seamless with a 100% digital, person-first product LOS ANGELES, May 11, 2022 /PRNewswire/ — Whole-trip travel insurance startup Faye today announced it has raised $8M in seed funding, led by Viola Ventures and F2 Venture Capital, with participation from Portage Ventures, Global Founders Capital (GFC) and former NBA player Omri Casspi. The news comes on the heels of the company exiting stealth mode last month to introduce a more tech-driven, quick, person-first travel coverage and care offering to American consumers. Get your upcoming trips covered in 60 seconds and travel worry-free with Faye, the…

Cyber Risk Quantification Insurtech company – Kovrr, launched a free platform to analyze Cyber Risk Quantification. The tool is powered by Kovrr’s Quantum CRQ (Cyber Risk Quantification) Platform. Kovrr: “Quantum is designed to enable enterprise decision-makers to comprehensively manage their cyber risk exposure by empowering them to seamlessly drive actionable, financial quantified cyber risk decisions, on-demand. Quantum’s data driven approach delivers CISOs, CROs, board members and other decision makers the answers they need with the click of a button”.

Encova boosts its workers’ compensation processing power with onboarding of new technologies Sapiens International Corporation (NASDAQ and TASE: SPNS), a leading global provider of software solutions for the insurance industry, has announced that Encova Insurance has upgraded its Sapiens CoreSuite for Workers’ Compensation platform, to continue to leverage the solution’s future-proof architecture while capturing its newest features and functions. Encova is represented by more than 2,000 independent agencies with staff who live and work in local communities throughout 28 states and the District of Columbia. The upgrade protects their IT environment against near- and long-term obsoletion by enabling Encova to accommodate emerging…

Menora to use Digital Completion Platform to Process Life Insurance Claims in Just Days as it Continues to Invest Heavily in Technology to Provide a Better Customer Experience and Internal Processes Lightico, whose next-generation digital completion platform supports millions of insurance, automotive, telecom and financial interactions, announced today that Menora Mivtachim has chosen its Digital Completion Cloud to enable the streamlining of its customer experience. Through the platform, Menora Mivtachim can provide rapid customer service and obtain the required documents in claims, redemptions and loan processes in a fast and convenient manner. “The launch of the new digital process with…

Levitan Sharon law firm have decided to join the network of law firms that assist the Israeli High-Tech Industry with a specific spotlight on Insurance. However, it seems like the experience with the Israeli Insurtech Startups, shows that they mostly would like to operate outside Israel, with the intention of building their company and making an exit. INSURTECH ISRAEL NEWS magazine joined ADV. Tammy Greenberg, ADV. Oded Cederboim, and ADV. Sharon Shefer – partners at Levitan Sharon law firm, to a conversation in the matter. What can Levitan Sharon Law firm do to assist and where do you see your…