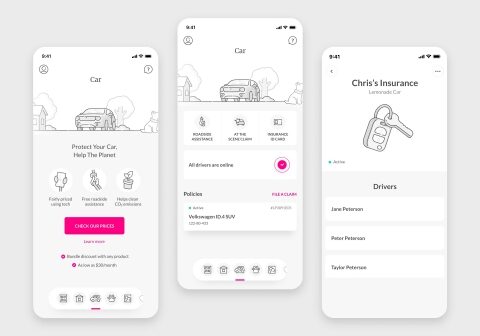

Lemonade’s newest product features great prices for safe drivers, best-in-class service, and perks for environment-conscious customers. Lemonade, the insurance company powered by AI and social good, today unveiled its newest product – Lemonade Car – designed to bring a fresh, tech-first approach to the category. Lemonade Car is now available in Illinois and will be rolling out nationwide. Lemonade Car is designed to offer better prices for safe and low-mileage drivers, as well as environment -friendly EVs and hybrid cars. The Lemonade app uses telematics to measure how much and how safe people drive, as well as provide 24/7 on-location roadside…

Browsing: #featured

Capital will be used to accelerate growth in the US and other geographic regions, as well as support expansion into new verticals and product use cases EasySend, a no-code digital customer journey platform, just announced a 50.5 million dollars Series B funding round led by Oak HC/FT. Existing investors Vertex IL, Intel Capital, and Hanaco Venture also participated in the round. The company also secured 5 million dollars in venture debt from Silicon Valley Bank. The announcement follows a year of accelerated growth — the company expanded its US revenues by ten-fold as it supported digital transformation for leading insurance, banks, and…

The selected startups have innovative technologies that operate in the fields of insurtech, digital, data, artificial intelligence, cyber and customer experience. The prestigious event was attended by: Dr Moshe Bareket, Director General of Israel’s Capital Market, Insurance & Saving Authority, Yehuda Ben-Assayag, CEO of Menora Mivtachim, Daniel Melka, CEO of IBM Israel, Moshe Morgenstern, Deputy CEO and Director of the Information and Technology Systems Division at Menora Mivtachim and Ofer Brandt, Chief Actuary and Senior Deputy to the Commissioner for Insurance Innovation Menora Mivtachim and seven large international insurance companies have successfully located 12 Israeli startups for IBM’s Alpha Zone…

Today Team Air Doctor took part in the Jerusalem Marathon! We are committed not only to helping sick people abroad, but also to pursue healthy living. We ran the marathon is in support of Crossroads Jerusalem, a foundation that provides essential prevention and intervention programs for Anglo teens and young adults in Israel in order to reach their potential and thrive. Till next year!

Mr. Aigrain will help lead the transformation of the alternative risk transfer market for insurers and investors. Vesttoo, a leading global alternative reinsurance and investment platform, today announced the appointment of insurance industry veteran Jacques Aigrain as Chairman of the Advisory Board. Mr. Aigrain brings nearly 30 years of leadership experience in insurance, reinsurance and capital markets, including previous roles such as CEO of Swiss Re, senior financial advisor at Warburg Pincus LLC and leadership roles at JP Morgan in New York, London and Paris. Yaniv Bertele, CEO and Founder, Vesttoo, said: “Vesttoo is honored to welcome an executive of Jacques’s calibre to lead…

“Optimizing Straight-through Processing with Remote, Real-time Health Data Collection” – that is the focus of Binah.ai’s Next webinar, which will take place on Wednesday, November 3rd, at 11:00 AM ET. In the webinar, David Maman, Co-founder and CEO of Binah.ai, will explain how Binah.ai’s technology can help insurers easily access client-provided, real-time health data to drive automation in underwriting. Maman will demonstrate how insurers can measure a wide range of health parameters remotely, just by having clients look at the camera of their own smartphone, tablet or laptop. Making access to health data easy and affordable, Binah.ai’s Health Data…

The ITC conference held in Las Vegas for the past 7 years was held this year after about two years in a face-to-face format. The main conference in the insurtech world attracts thousands of participants from all over the world. The Israeli delegation to the conference, led by Kobi Bendelak, CEO of Insurtech Israel, included 60 participants and 18 startups, including binah.ai, Air Doctor, RAVIN.AI, Futura Genetics, Five Sigma, Insurights Inc., OpenLegacy, Kissterra, Lightico, FIXC, EasySend, DigitalOwl, Contguard, LEO, Toonimo, Urbanico and Joshu, who presented their experiences. Bendelak notes that the conference is a great platform for startups to showcase their capabilities…

The Israeli Insurtech accelerator, opened its second cohort this month, Following the success of the first Cohort. Kobi Bendelak, CEO of InsurTech Israel, who together with Ayalon Insurance leads the accelerator’s activity, notes that over 40 Israeli Insurtech startups were registered for the second Cohort, which indicates the development of the industry in Israel and the great trust that the industry acquires in the Israeli Insurtech Accelerator activities For the second Cohort, startups were selected from a very wide range of technologies and solutions for the insurance world, such as Psyber, which deals with cyber insurance and providing protection and…

Group 11 leads this investment round in the company bringing simplicity and transparency to the historically complex industry of employer-sponsored health benefits in the U.S. Insurights, the AI-powered platform designed to improve human health by allowing employees to seamlessly access, understand and utilize their health benefits, today announced a total of $22M in seed investment led by Group 11. The platform is bringing on-demand, personally tailored answers to any employee with questions on how to navigate their employer-provided health benefits, regardless of their insurance provider. In addition to the profound impact on an employee’s mental and physical wellbeing, the lack…

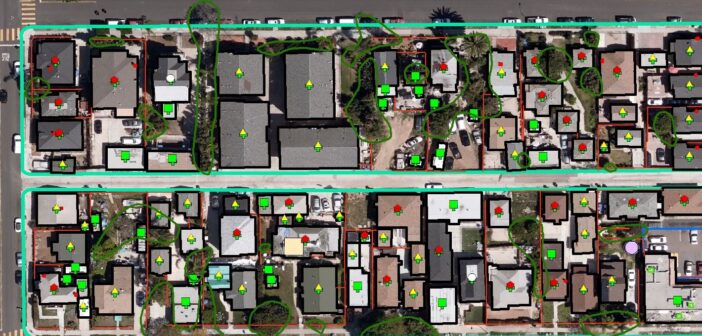

Strategic Partnership Brings Together Aerial Imagery, Advanced Analytics, and AI to Help Customers Accurately Assess Risk, Prevent Fraud, and Reduce Costs. GEOX, a supplier of geospatial data to insurers, has today announced a strategic collaboration with EXL, a global analytics and digital solutions company, to deliver an integrated image analytics offering to insurance carriers. The joint solution aims to better assist carriers in achieving improved underwriting assessment, smart roof condition assessment, more precise property renewal assessment, and better claims processing support. “Data, analytics, and AI capabilities are integral for success in the P&C insurance vertical,” said Vivek Jetley, EVP and Head…