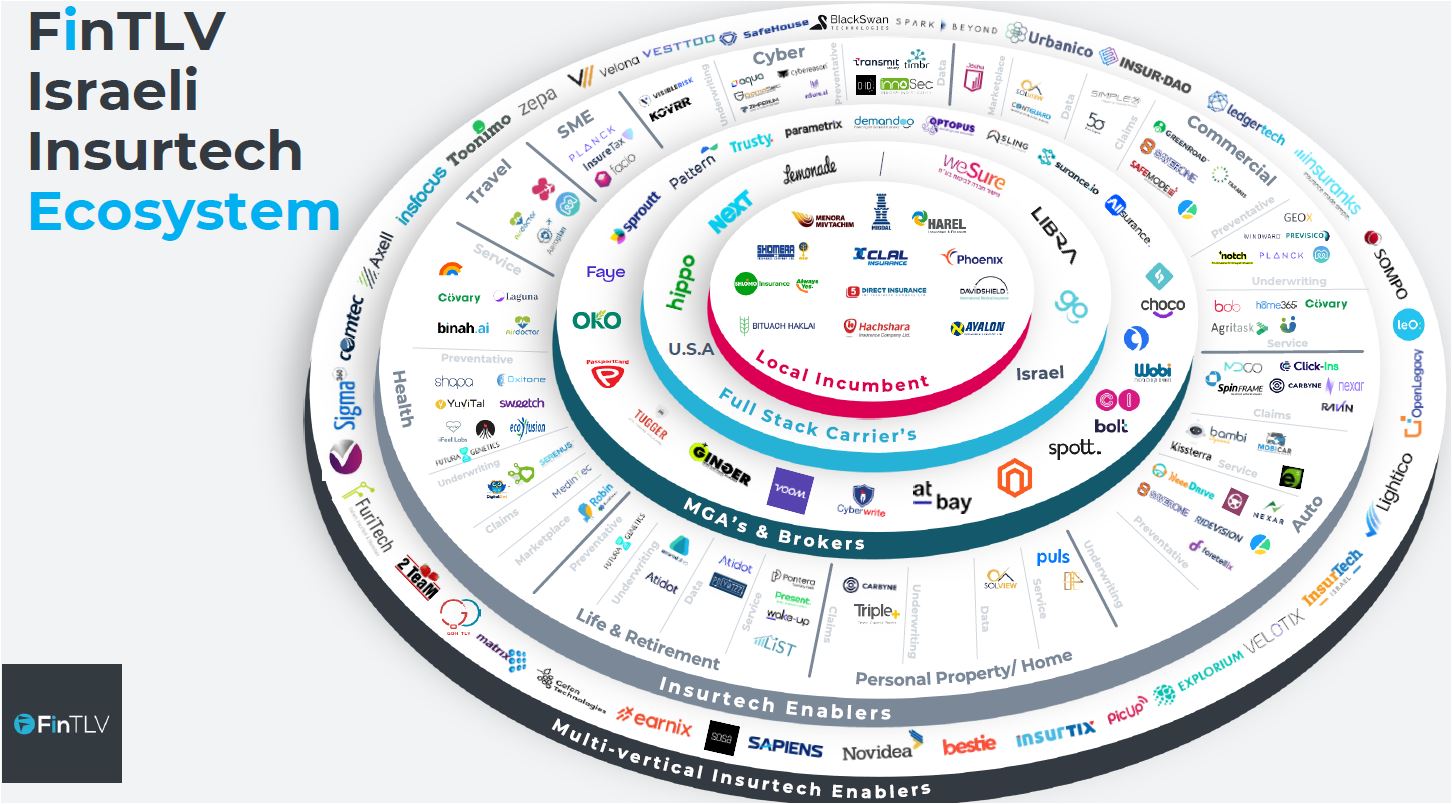

The FinTLV global fund has mapped the 2022 Israeli eco-system. According to the fund, the map includes any start-up with potential for bringing about change in the insurance sector – new products, an improved customer experience, improved work processes and smarter and more efficient marketing

Gil Arazi

The global FinTLV fund has mapped the Israeli eco-system in the area of insurtech in 2022 and it presents its conclusions regarding the industry and its trends. “The insurtech sector is continuing to grow and develop. Like the insurance companies, insurtech comprises a wide range of solutions, ideas, products and companies influencing all aspects of our lives”, says the fund.

FinTLV founding partner Gil Arazi told Policy: “Despite the world collapse of tech shares – insurtech in Israel is continuing to grow”.

FinTLV says that the eco-system is varied and the map provides the observer with a birds eye view and a comprehensive understanding of how it is segmented and who the main players are in each sector and sub-sector. FinTLV is a global venture capital fund that specializes and focuses on insurtech, with investments mainly overseas, but, they say, they see as being of major importance the ability to connect with and assist the Israeli eco-system via giving significant value and assistance to all companies, regardless of the decision on whether to invest in them, “We will continue to accompany and support the Israeli eco-system and assist by means of ongoing investments, identifying business opportunities and potential partnerships and assisting all companies in the sector”.

FinTLV says that the map includes any start-up with potential for bringing about change in the insurance sector – “ any start-up offering new products, an improved customer experience, improved work processes in the insurance sector – underwriting, sales, claims or assisting new and older insurance companies to market more smartly and more efficiently”.

After mapping the insurtech sector in Israel, the fund identified the various players and their functions in the business environment and also areas that are saturated with initiated innovative actions and areas waiting for change – “for disruption”.

FinTlv Israeli Insurtech Ecosystem

The insurtech map

The map consists of a series of concentric circles:

The innermost circle consists of the core of the Israeli insurance industry – the Israeli insurance companies.

The next circle shows the new insurance companies. The insurtech companies in this category started out as distributors or agents who do not bear the insurance risk (MGA Managing General Agents, agencies that receive powers from insurance companies) and then go on to developing into insurers (apart from Lemonade, which started out as an insurer). These are Israeli companies that grew in the last five years and companies with an Israeli connection but operating mainly in the USA..

The third ring shows MGA’s and brokers. This ring consists of all companies that provide services or manage insurance coverage.

According to FinTLV, there is a dispute as to the definition of insurtech and which companies fall within the definition. Thus the fund chose to define any company selling insurance as a producer or distributor. The fourth ring is called the “enablers” ring, consisting of companies which are not insurance companies, agencies or agents, but at the same time perform a vital function in the insurance value chain. These are companies that provides vital services or tools to the sector, such as a technology used to improve pricing, claims or underwriting.

“This ring is divided into the insurance sectors. The division into sectors eases identification of highly saturated sectors and those in need of more innovation. In addition we split up the services provided by these companies in each sector. We identified the significant areas and divided them according to risk prevention, underwriting, data and service (including companies providing services to insurance companies in a range of areas”).

The company claims that this division enables obtaining a more detailed picture of the various insurance areas, making it possible for a company appearing in a particular segment to appear simultaneously in other segments.

The outermost and last ring are companies that are not limited to a particular segment. Their services include, amongst other things, development of platforms for the insurance sector, marketing, innovation accelerators, who are active in all areas of insurance and are thus not represented under sub-categories.