Upendra Belhe

Guy Attar

By Dr. Upendra Belhe, President, Belhe analytics advisory and Guy Attar, Co-founder & Executive Chairman, GEOX

Property and casualty (P&C) insurance represents $1.6 trillion in premiums (about one-third of the insurance industry). Industry reports state that the Homeowners’ Insurance segment alone is $105.7bn in 2020.

The insurance industry is evolving. Property and casualty insurance now benefit from risk models that analyze huge and diverse data sets. New data source influencers are emerging in the insurance industry, with the hope to provide the most comprehensive and accurate assessment of a property. Comprehensive address, parcel and building information; current and historical owners, deeds and tax assessments; precise valuations are some of the data types that are typically gathered.

Data brings operational efficiency

With Property Imagery, insurers now have a virtual way to closely view personal or commercial property and can easily validate property characteristics without leaving their desks. For customers this offers an ease to do business as they no longer have to answer a seemingly endless list of questions. On the other hand, for the underwriters and agents, this means increased efficiency at point-of-sale.

At the time of obtaining the insurance coverage, the owners may optimistically overestimate the roof condition or brokers seem to be comfortable offering their best estimate for the total square footage. Advanced imagery based data producers are making it more efficient to determine the condition and characteristics of a roof and accurately state square footage and many other features so underwriters can accurately price the risk.

When insurance adjusters inspect a roof, it is a time consuming and potentially dangerous endeavor and imaging is increasingly being used as a valid option. When hail and wind events happen, image data can tell the insurance carrier which properties were impacted so they can deploy resources to the right areas and quickly estimate the cost of roof claims. In such instances how quickly accurate data becomes affordably available post events has direct impact on the carrier’s bottom-line.

New Frontiers of Property Data

Insurers are increasingly competing based on internal and external sources of data. In case of personal and commercial property insurance, the decision makers having more and better property details is becoming a competitive edge for the carriers. It is also important for the carriers to stay up to date on the known attributes and strive to obtain the new attributes as they become available.

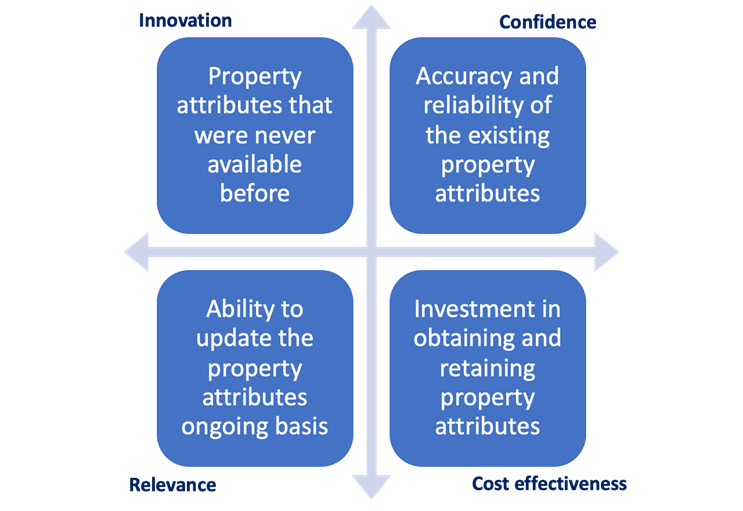

In general, there are 4 dimensions of improving on the property physical details to stay profitable and competitive in the insurance marketplace.

The property physical attributes data providers need to be evaluated on each of these four dimensions.

- Innovation – Are they persistently investing in research and development to add new attributes that were never available in the industry? For example, can they provide the height of a nearby tree and its distance from the property?

- Confidence – How accurate are the attributes? Are they measured based on 2D or 3D images? Can they provide attributes like the number of floors and total volume? How accurate are they in stating square footage for the property in question?

- Relevance – Can they make accurate damage assessment data available to the claims team post events? How frequently can they provide updates to the property attributes? Also, can the claims team assess any roof damage in the form of missing shingles or presence of tarp on the roof based on the updates?

- Cost effectiveness – Are they too pricey? For example, can they provide data for thousands of properties within reasonable cost?

Concluding Remarks

Personal and Commercial Property insurers are finding it increasingly important to use newly produced accurate attributes for the property risks of their interest. They are rapidly making such data an essential part of their workflows and decision making. The landscape of property claims and underwriting is becoming a lot more data driven and competitive based on the carrier’s ability to leverage newly available sources of accurate data.

Guy Attar, Co-founder & Executive Chairman, GEOX, [email protected]

Dr. Upendra Belhe, President, Belhe analytics advisory, [email protected]