Novidea, creator of the cloud-based, data-driven enterprise insurance management platform for insurance agencies, brokers, carriers, and MGAs/MGUs, announced that Madanes Insurance Agency, a leading insurance broker specializing in large and complex insurance schemes in the property, liability and health sectors, as well risk management and claims management, has gone live with its insurance management platform. Madanes has a large and diverse customer base and responds to thousands of inquiries daily. Given Novidea’s experience with global insurance organizations and its end-to-end support for the insurance distribution lifecycle, Madanes selected the Novidea platform, which is now fully operational and serves hundreds…

Browsing: #featured

Guardz expand their presence into the Canadian market through an exclusive partnership with iON United Inc. (iON), one of Canada’s leading cybersecurity solutions providers. This collaboration is not just a strategic move; it’s a leap forward in our mission to empower small and medium-sized businesses (SMBs) with top-tier cybersecurity solutions. Guardz and iON: A Synergistic Partnership Guardz and iON are coming together to launch iON Guardian, a powerful new platform designed to address the unique cybersecurity challenges faced by SMBs. This partnership leverages Guardz’s innovative, AI-powered technology with iON’s extensive local network and deep understanding of the Canadian market. “We’re…

In this installment of our series on the Israeli Insurtech delegation attending the upcoming ITC Vegas convention in October 2024, we are thrilled to introduce our readers to the innovative companies reshaping the insurance landscape, continuing with Five Sigma, and delve into the depth of their journeys, challenges, and cutting-edge technologies through in-depth interviews. Business Challenges and Solutions What are the main challenges you have faced so far? Challenges include convincing traditional insurers to transition from legacy systems to a modern, cloud-based platform and navigating the regulatory landscape across different regions. How have you overcome these challenges? We overcome these…

In this first installment of our series on the Israeli Insurtech delegation attending the upcoming ITC Vegas convention in October 2024, we are thrilled to introduce our readers to the innovative companies reshaping the insurance landscape, starting with Ravin.AI, and delve into the depth of their journeys, challenges, and cutting-edge technologies through in-depth interviews. Ravin AI Ravin AI is at the forefront of revolutionizing the insurance industry by leveraging artificial intelligence to automate vehicle assessments. We help insurers capture a vehicle’s physical condition at the point of inception/underwriting to flag potential risks, as well as streamline a motor claim by…

Transamerica Life’s Senior Director Keith Brown Joins DigitalOwl’s Client Advisory Board. At Transamerica Life, Brown oversees the Medical Department, Risk Management, and Forensic Underwriting teams, managing underwriting auditing and control functions. the company noted that, Keith brings a wealth of knowledge and expertise, particularly in critical thinking and thought leadership. His vast experience, including roles as Chief Underwriter at various companies and most recently as Senior Vice President, Head of Individual Life at Gen Re, will be invaluable as we continue to expand and refine our AI-driven solutions for insurance carriers. Keith is widely respected in the industry for his…

The Israeli Insurtech Accelerator is Announcing the Commencement of the 7th Cohort of the Acceleration Program. Over the next five weeks, their selected startups will delve deep into the insurance industry, gaining insights and guidance from leading international mentors and participating in specialized workshops with our esteemed business partners: BrokerTech Ventures, AIG, IAG Firemark Ventures, Lloyd’s, Aon Reinsurance Israel, Sompo Digital Lab Tel Aviv, Unum, AF – Group, Migdal Insurance, IDI, Dell Technologies, Sapiens, Microsoft, Milliman, McDermott Will & Emery, Gross Orad Schlimoff & Co., ReSource Pro, EasySend, and Meitar Law Offices. Kobi Bendelak, CEO of Insurtech Israel, said, “This…

The leading in-home senior care franchise is rolling out advanced artificial intelligence technology across the country to enhance care and safety for seniors around the clock. BLUE BELL, Pa., June 12, 2024 /PRNewswire-PRWeb/ — Griswold, a pioneer in non-medical senior care, is thrilled to announce its national partnership with Sensi.AI, expanding the innovative 24/7 in-home technology to several new locations across the United States. This strategic alliance has been embraced by multiple offices across the U.S., with plans to roll out further within the Griswold franchise network. “We are excited about our preferred partnership agreement with Sensi.AI — they provide virtual care assessment…

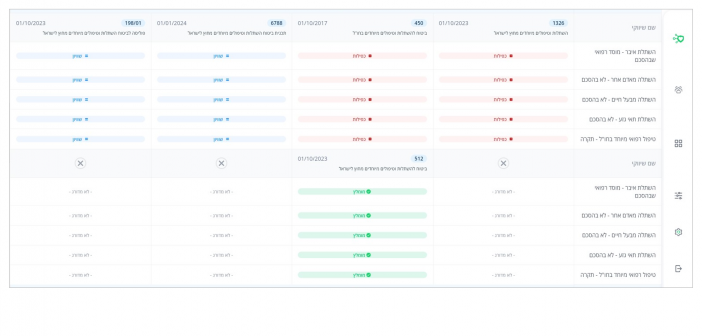

For the first time in Israel, the Israeli insurtech company MediMe is launching an innovative platform for insurance agents, focusing on the marketing and sales of health policies using advanced AI technology. The MediMe.AI system uses artificial intelligence to learn and analyze the entitlements of various policies, organize the data for the agent’s use, and compare different policies. MediMe.AI allows any insurance agent, without any technical background, to perform complex analyses that until now only large, expensive, slow, and complicated commercial systems could do. It is reported that MediMe.AI operates quickly and accurately, reducing the agent’s work time by 80%,…

NEXT Insurance, a leading digital insurer transforming small business insurance, announced the availability of its Business Owner’s Policy (BOP), a comprehensive insurance solution designed with the specific needs of small businesses in mind. Building upon NEXT’s AI-powered, proprietary platform and underwriting expertise, NEXT’s BOP offering enables agents to easily provide their small business clients with liability and property insurance coverage under a single policy that is simple to quote, bind and manage. NEXT’s BOP is particularly ideal for ‘main street’ small businesses, including restaurants, retail, and professional services. It combines the insurance coverage they most often need to protect their standard business operations and allows…

Binah.ai, the leading provider of artificial intelligence (AI)-powered health and wellness check software, announced today that its technology now allows organizations to conduct respiratory health checks by simply having users cough into a smartphone microphone. The initial respiratory health indicators detect smokers and assess tuberculosis risk, with additional indicators expected to be available by the end of the year. Binah.ai’s technology empowers organizations to enable anyone to measure and share a wide range of health and wellness indicators using a camera-equipped device such as a smartphone or tablet. The software-based solution measures important health data, including blood pressure, heart rate,…