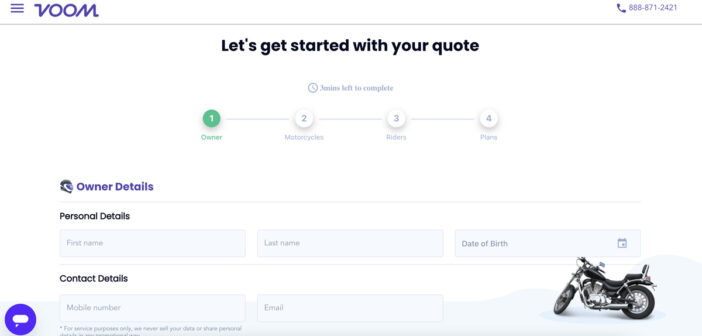

VOOM Insurance, the only pay-per-mile motorcycle insurance provider, is expanding its innovative offering to motorcyclists in three additional states: Texas, Tennessee and Missouri. Motorcycle owners in these states who ride less than 2,000 miles a year, per bike, such as weekend warriors, occasional riders, and multiple motorcycle owners, can save up to 60% compared to traditional motorcycle insurance plans, starting as low as $50 per year. In an age of inflation, VOOM aims to help riders keep more money in their pockets. “Our team is excited to be able to introduce our product to the Lone Star state, one of…

Browsing: #featured

As the insurtech ecosystem continues to grow and evolve, startups within the industry will likely face a number of challenges in 2023. These challenges may include navigating regulatory compliance, intense competition, gaining customer adoption, protecting customer data, and integrating with traditional insurers. While the specific challenges that insurtech startups will face in 2023 are difficult to predict, it is clear that the insurance industry will rely on these startups to transform their customer relationships. In order to help insurtech startups overcome these challenges and achieve their goals, they may need to optimize their solutions, utilize all available resources to attract…

By: Roi Agababa , CEO and Co-Founder, Novidea As we rapidly approach 2023, we can see that the insurance industry continues to evolve, adopting more and more technologies to grow their businesses. As CEO of a cloud-based, data-driven platform for brokers, agents, and MGAs, we observe on a daily basis the urgency insurance brokers and agencies face to accelerate their digital transformation initiatives in order to stay competitive in the market. Digitalization is widespread in almost all industries, such as healthcare and banking, but we now can see that insurance is now at a significant inflection point. The next generation…

In 2021, there were 623 million cyberattacks worldwide. If there’s an opportunity to enter a business’s premises undetected, cybercriminals will find it. In the digital age, no organization is safe from cyberthreats. Size doesn’t matter. A recent report by cyber insurance provider At-Bay highlights that ransomware is the biggest digital threat to American businesses, responsible for an estimated 60% of all domestic cyber insurance claims in 2020. In the last year, the average ransom payment has nearly doubled, and the average total loss is $1.8 million for a single incident. Rotem Iram, co-founder and CEO of At-Bay, explained that a…

The annual contest of the Top Israeli insurtech companies and start-up officially begins. The Top Insurtechs will be chosen in the following Categories: 1. AI 2. Claims 3. Climate 4. Cyber 5. Health 6. Life 7. Marine 8. P&C 9. Pet 10. platform 11. Sales 12. Service 13. Travel 14. Underwriting 15. Wellness The contest is based on the results of a public survey, Open to all the insurtech ecosystem in Israel and Abroad (75%) and the votes of a team of professional judges (25%). Every Vote Counts – Hurry up and Vote.This year, We’re adding a special Category: The Insurer’s Choice The winner of this category will be Chosen By a team from Menora…

Serenus.AI will present its work for the development of an AI-based Personalized CDSS for the Treatment of Chronic Lymphocytic Leukemia (CLL), at the 2022 annual ASH meeting. The work is the result of a collaboration with J-C Health Care Ltd Israel with the aim to improve outcomes for patients living with CLL. The American Cancer Society estimates that in 2022 about 20,160 new cases of CLL were diagnosed, with estimated deaths of 4,410 persons. With advanced machine learning technologies, the system shall allow medical professionals in the future to constantly be updated with the latest research in the field and improve patients’ outcomes. Prof. Elidan,…

The study, led by insurtech innovator Five Sigma, finds claims departments suffer from inefficiency and long claims processing times due to lack of automation. Five Sigma, an emerging leader in cloud-native insurance claims management solutions (CMS), today announced the key findings from a recent survey providing insight into the performance of claims departments within major insurance companies in the U.S. The results of the survey paint a picture of claims departments at a tipping point. While respondents pointed to inefficiencies stemming from a lack of automation, they also showed an eagerness to increasingly implement innovative technologies and automate key workflows. The survey…

VOOM integrates their insurance offerings into the new Motocross social platform, Full Throttle Full Throttle customers save with pay per mile motorcycle insurance. With VOOM’s innovative technology, riders can save up to 60%, with rates as low as $50 per year. Instead of paying an annual flat fee, your insurance rate is based on your actual mileage. No tracking or hardware required. 70% of riders overpay with traditional motorcycle insurance by paying a fixed rate, even for the times they don’t ride their bikes. If you ride less, you should pay less, that simple. Full Throttle, launching in 2023, is…

The reinsurance capacity is provided by certain underwriters from Lloyd’s of London and Hannover Re. Parametrix, the leading provider of downtime insurance, this week announced it is strengthening and expanding its operations in the United States with additional reinsurance capacity. Partners Hannover Re and certain underwriters from Lloyd’s, including Tokio Marine Kiln, RenaissanceRe, and Apollo (through ibott Syndicate 1971) will join or have renewed their commitment to the Parametrix panel of reinsurers. The new structure is brokered by Howden Insurance Brokers Limited, UK. Parametrix, headquartered in New York, is a registered coverholder at Lloyd’s of London. Concerns about cloud downtime risk exposure are increasing, as shown in a recent Parametrix…

Q&A with IAG Firemark Ventures General Manager Scott Gunther What does Firemark Ventures do? Firemark Ventures, IAG’s strategic corporate venture capital (CVC) fund, was launched in 2016 to literally bring the outside world in. By strategically partnering and investing with start-ups that have capabilities to materially alter IAG’s insurance business, Firemark is building an incubation ecosystem across industry, venture capital, academia and government, to identify opportunities to explore, evaluate and create mutual commercial value. What are your goals in the co-operation with Insurtech Israel? IAGFV has expanded its international investment focus, engaging with non-competing global insurer CVCs which are focused…