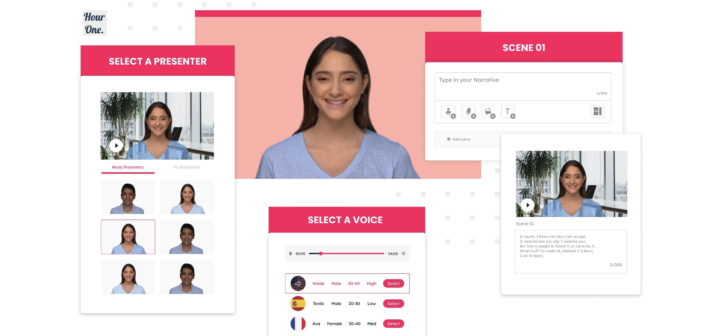

Hour One, the AI video generation company powered by virtual human characters, today announced that it has raised a $20 million Series A funding round to put more virtual humans in the virtual workplace. The round was led by New York-based private equity and venture capital firm Insight Partners with participation from Galaxy Interactive, Remagine Ventures, Kindred Ventures, Semble Ventures, Cerca Partners, Digital-Horizon and Eynat Guez. The funding round will be used to further enhance and streamline the process of becoming a virtual human on the platform, making it possible from any mobile device, with studio quality video creation and…

Browsing: #featured

SCOR and its subsidiary ReMark announce that they have signed a partnership agreement with Atidot on a solution designed to increase in-force business value for life insurers. The innovative digital solution will deliver significant value for the partners’ clients by better predicting policyholder behavior and developing engaging marketing strategies to retain customers. A global reinsurer, SCOR continues to leverage its industry expertise and collaboration with ecosystem partners to design and offer innovative solutions to its clients that help drive growth, solve key business problems, and achieve strategic objectives. “SCOR believes that it’s not enough for a reinsurer to provide competitive…

LeO, the Israeli insurtech company has published at Monday, at the company’s business page at LinkedIn, an announcement that the company have appointed Michael LaBella and Scott Angell as VP of Sales and Director of US Sales. the notice said, that “they will help LeO to continue our mission to serve the industry in the most professional and value-driven way.”

Atidot, the industry leader in providing state-of-the-art predictive analytics and artificial intelligence to life insurance companies, is proud to announce that Sherry Chan has joined the team in the position of Chief Strategy Officer. Chan started with Atidot in 2021 and brings a strong background as a highly respected actuary with a proven leadership record. Before joining Atidot, Chan spent nearly seven years as the Chief Actuary for the City of New York. An expert in strategic policy operations and relationship management, Chan was instrumental in helping the beneficiaries of over 300 public employees who died from COVID-19 access historical…

Lightico, whose next-generation digital completion platform supports millions of insurance, automotive, telecom and financial interactions, announced today that Menora Mivtachim has chosen its Digital Completion Cloud to enable the streamlining of its customer experience. Through the platform, Menora Mivtachim can provide rapid customer service and obtain the required documents in claims, redemptions and loan processes in a fast and convenient manner. “The launch of the new digital process with Lightico allows us to improve customer service and customer experience while simultaneously improving our internal work processes,” said Moshe Morgenstern, Deputy CEO of Menora Mivtachim, and Director of Information Systems and…

Microsoft Israel joins the Israeli Insurtech Accelerator. Microsoft’s joining will allow Israeli startups access to Microsoft’s global business network, its many technological capabilities and grants that can reach $120,000 for a startup to use the advanced Azure cloud service. Microsoft has set itself the goal in recent years of becoming a major technology enabler in the field of finance and insurtech. The company will provide a platform on which startups and insurance companies can develop and sell the most advanced technologies in the field, while meeting built-in compliance standards within the company’s cloud. This activity largely represents the latest technological…

Wesure group is continuing to deploy for completion of the deal for the acquisition of the Ayalon Holdings insurance group, and last week reported on the signing of amended agreements, running up to completion of the deal, with the Levy Rachmani estate’s executor and with Caesarea Medical Electronics (Caesarea), controlled by Tzvi and Anat Barak. According to the updated agreement with the executor of the estate, agreement was reached, amongst other things, on a reduction of 10 million shekels in the consideration amount, to 462.7 million shekels, in consideration of which Wesure will acquire 67% of the Ayalon Group shares.…

Parametrix, the provider of technology downtime insurance, today announced Cloud Downtime Insurance for Crypto is available to insure crypto companies against cloud outages. Should a crypto exchange, wallet, DeFi or platform become inaccessible due to an outage of a public cloud provider, Cloud Downtime Insurance for Crypto from Parametrix would enable the crypto company to help protect its customers from losses. In addition, the 2022 Crypto Confidence Report, a survey sponsored by Parametrix, indicates trust is a top concern both for crypto users and non-users; Cloud Downtime Insurance for Crypto is designed to help build confidence in the crypto market.…

Sapiens International Corporation, (NASDAQ and TASE: SPNS), a leading global provider of software solutions for the insurance industry, announced that Applied Underwriters, Inc.®, a global risk services firm, selected Sapiens ReinsurancePro to automate their reinsurance administration, accounting, analysis and reporting. The solution will enable Applied Underwriters, Inc.® to replace their legacy process with a platform that is streamlined, consistent and financially correct. Sapiens ReinsurancePro efficiently automates the underwriting and administration of reinsurance, including treaty and facultative, ceded, assumed and retroceded reinsurance. “With the significant growth of our product offering and reinsurance portfolio, it is no longer sensible to track and book…

Impressive Israeli Presence was noticed at the Insurtech Insight 2022 Conference. among others, participated Kobi Bendelak, Gil Arazi, Adv. Sharon Shefer, Yinon Dolev, and others. Bendelak, CEO of Insurtech Israel, Lead a delegation on Israeli Insurtech Startups: Five Sigma RAVIN.AI OpenLegacy Atidot Lightico Emnotion Mobile2CRM YuviTal (Formerly Rumble Wellness) Futura Genetics Insurtix Toonimo binah.ai Planck Some of these start-ups recruited A sum of 350 million Dollars in the lest months. bendelak commented that It was very noticeable that the Israeli delegation attracted a lot of attention from all the conference participants.