Q&A with Moshe Brown, Co-Founder at Socalytix What does Socalytix do? There are two areas that we cover, The first issue we cover is in the insurance existing customer base. Insurance companies have enormous amounts of data on their customers, most of it is static data, their issue is that they do not have information about their recent life events (recent family status, work, education, etc.). Due to this reason insurance companies fail to manage their passive clients data base, tending to recruit new clients Vs cultivating existing clients. The painful fact is that recruiting new customers is much more expensive…

Browsing: #featured

The Wolt deliveries platform is transferring its delivery drivers insurances to the Collective Benefits brokerage. Wolt is insuring, as of July 1, its delivery drivers for personal accidents at Lloyd’s via the Collective Benefits brokerage and third party insurance will be covered by QBE, fronted by Harel, with no deductible. The company says that it will finance the cost of the extended insurance, which is estimated at 1,500 shekels in the private market. Until now the delivery drivers were insured for death and disability by Demandoo. The company says that the new insurance will cover fractures that are common amongst…

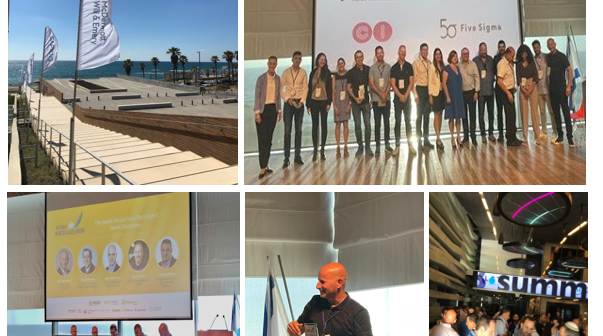

The Israeli Insurtech Accelerator, which was established by Ayalon, Insurtech Israel and the American BrokerTech Ventures insurance giant, has completed its first Cohort. Participating in the first cycle were: Insurights – which assists insureds in realizing their rights in health insurance Ravin – which is developing a system for remote checking of vehicles GamaSec – which is developing cyber protection systems Serenus.AI – which has developed a system for checking medical decisions and preventing unnecessary treatments CI – which has developed an embedded insurance-based model for selling insurance Five Sigma – which has developed a claims handling platform. The accelerator’s…

Libra is completing a successful share floatation which commenced a few weeks ago. The company reports a heavy response from investors and over-subscription, which led to a cessation of the investor presentations round within just two days, and raising the share price to 10.56 shekels – higher than presented in the prospectus (9.4 shekels per share). Libra is now expected to be floated on a valuation of 450 million shekels before the money – some 50 million shekels more than the initial valuation requested in the prospectus. In the coming year, Libra expects to expand its license to also include…

The Israeli insurtech company Honeycomb (formerly Agilius) has launched its innovative insurance platform in North America, following the raising of 3.3 million dollars, led by the Phoenix, New Era Capital Partners, IT-Farm Corporation and NFP Ventures. Honeycomb is entering a market estimated at 22 billion dollars, offering the customer a simple, efficient and transparent experience in a market consisting of 53 million households in the USA. Honeycomb is the first insurance platform creating a change in the purchasing, underwriting and management of insurance for condominiums. Currently, the purchase of insurance in the USA and over most of the world is…

One of the most difficult problems in the insurance sector is the complexity of insurance products, creating a long and complicated purchase process. Thus, until a few years ago, insurance was sold mainly by agents. The increasing presence of digital tools in recent years has resulted in the development of direct distribution channels between the insurance companies and insurers and a simplification of the purchasing processes, but there is still a need for a transfer of much information between the insured and the insurance company in order to execute the purchase. The connected insurance model succeeds in solving the problem…

The Davidshield-Passportcard travel insurance company came first in an international innovation competition which was held in Germany in the health category – “Payment in real time – a pioneering solution changing the customer experience”. The company was awarded a prestigious prize, awarded this year in virtual format, without a physical meeting at the conference which was planned to take place in Berlin. The company says that the prize committee needed to decide between tens of European and international companies in different areas of activity, and represents a quality stamp for the company’s services around the world, amongst other things in…

WeSure has received its first US insurance producer/license, in New Jersey. According to the company’s plans, the intention is to initially start with SME insurance, offering an insurance package for small businesses. It is expected that the company will start operating in 2021-2022. The first license was granted by the New Jersey State Banking and Insurance Division to the Wesure sub-subsidiary Wesure Digital Insurance Services Holdings Inc., which coordinates all of the group’s activity in the United States and is effectively held 100% by the company. The announcement by the company of it having received a license in New Jersey…

wefox, the Berlin-based digital insurance company has raised a record US$650 million for its Series C funding round led by Target Global, resulting in a post-money valuation of US$3 billion. Funding round was led by Target Global with participation from existing investors, including OMERS Ventures, G Squared, Merian, Horizons Ventures, Eurazeo, Mubadala Capital, Salesforce Ventures, Speedinvest, CreditEase, GR Capital and Seedcamp. Israeli venture capital firm FinTLV took part in the round. This round is the largest for an insurtech globally and one of largest series C rounds ever recorded. wefox intends to invest the proceeds in strengthening its presence in existing…

Novidea, developer of cloud-based solutions for the insurance industry, today announced that it has increased its funding by $15 million, led by IGP, adding to $15 million raised just several months ago. Novidea will use the funding to expand its operations in the USA and Europe and accelerate product innovation to meet increased market demand. Novidea, a leading provider of a cloud-based, data-driven InsurTech platform that enables brokers, agents, and MGAs to drive operational efficiencies and growth across the entire distribution lifecycle, today announced that it has secured $30 million in Series B financing, led by Israel Growth Partners (IGP)…