Apollo’s ibott division, a global provider of insurance and reinsurance solutions has signed a Memorandum of Understanding with an Israeli Insurtech, CI LTD. CI’s technology will enable Apollo’s clients to reduce their fleet and rider insurance costs and turn insurance into a revenue source by offering on-demand insurance. Chris Moore, Head of ibott at Apollo Syndicate Management Ltd., said: “We are proud and happy that we have found a partner that shares our vision and long-term strategy. CI brings its connected insurance technology to evolve an industry that is rapidly growing and with that growth comes a complex risk exposure that…

Browsing: #featured

Spinnaker Insurance Company, a national property and casualty insurer licensed in 50 states and rated A- (Excellent) by A.M. Best Company, wholly owned by Hippo Enterprises Inc., today announced the appointment of Torben Ostergaard as its new president and chief executive officer. Ostergaard joins Spinnaker after more than a decade in c-suite roles at insurance and financial services firm USAA. Dave Ingrey, who previously held the CEO position, will transition to chief operating officer and continue to play an integral role in shaping Spinnaker’s future. Most recently a Fortune 100 executive, Ostergaard brings 25 years’ experience as a risk officer…

OpenLegacy, which instantly transforms monolithic legacy applications into cloud-native building blocks, has announced significant momentum in the global banking sector. Financial institutions including Citibanamex, Banca Popolare di Sondrio, Banorte, Bank Hapoalim, Bank Leumi and Security Bank are using OpenLegacy to digitally transform legacy systems and step into a new era of innovation. “Our world-class roster of global banks and financial institutions demonstrates the hunger for a new approach to legacy integration,” said OpenLegacy Co-Founder and CEO Romi Stein. “Monolithic systems like mainframes weren’t built to support digital innovation, but with OpenLegacy, generating microservice-ready APIs from core applications becomes a non-issue.…

Israel’s international insurtech accelerator, established by Ayalon in collaboration with Insurtech Israel and BrokerTech Ventures held its half-time event last week. Insurtech Israel CEO Kobi Bendalek thanked all of the startups and partners. The event started with a series of interviews with the accelerator’s three business partners: Alex Zuckerman from Sapiens, Yinon Dolev from Sompo and Michael Byrne from McDermott Will and Emry. This was followed by a questions and answers session with Assaf Wand – CEO and founder of Hippo, one of the key influential people in the sector. Bendalek thanked Wand for his investment and support in developing…

Direct Insurance has launched the Direct SOS sensor which identifies road accidents in real time. The sensor identifies and analyzes road accident data in real time, these being sent automatically to the company. The sensor is able to give a good approximate estimate of the damage to the vehicle, the area of damage and its severity, and where there are injured parties the area of bodily injury and the severity of the injury. If there are bodily injuries, the sensor broadcasts directly to the MDA emergency ambulance service, which sends an ambulance to the accident scene. The data sent by…

By Rita Baal-Taxa VP Strategy & Partnerships, Vesttoo The insurance industry has been developing fast in the past few years. Companies have been focused on growth and increasing their Gross Written Premiums (GWP), but are facing increasing challenges such as tough competition, a low interest rate environment, growing customer expectations and regulatory scrutiny. New Insurtech players are entering the market, offering innovative services and cutting edge digital tools in order to overcome these challenges. These new tools and services fall into three main categories: An easy, intuitive and user-friendly purchase process from the initial offering until…

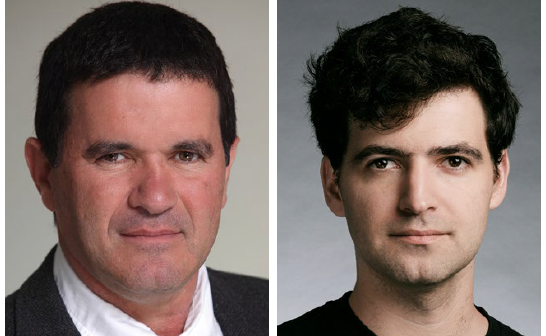

A new investment entity in the insurtech sector is starting out. SureTech, headed by former Clal Insurance Chairman Danny Naveh as Chairman of the partnership, is a limited partnership, which is currently acting to raise 36 million dollars. Additional directors – Dikla Wagner, Shuki Cohen Sharett CPA, Ido Ben Shitrit and Uzi Baruch CPA * Serving as CEO of the partnership will be Dan Tzror and as CFO and Business Development director – Doron Gedaliahu. SureTech has so far invested in two companies in the insurtech sector – Vesttoo – with an investment of 2 million dollars on a valuation…

Q&A with Ronnen Fischer, CO-CEO at Insurtix In the previous interview we talked about problems insurers face when implementing new core systems. How can Insurtix fit in that evolutionary process you talked about? Fischer: It took us a while to figure out what we managed to produce. It was clear to us, also based on our success (for example in the digital insurance company Libra), that we were able to develop a comprehensive core system for the insurance world. In the process, we performed with several other customers, we understood that from the ecosystem of our software company (CodeOasis)…

Lemonade, the insurance company powered by artificial intelligence and behavioral economics, announced it is readying ‘Lemonade Car’ for launch within the year. The US car insurance industry is estimated to be about $300 billion—70 times the size of both the renters and the pet insurance markets. A large majority of Lemonade’s existing customers are car owners, and they already spend about $1 billion on car insurance each year. “We’re seeing an overwhelming demand for a Lemonade car insurance product from our customers. And so, since last year, a large part of our team has been working on what we believe…

Sapiens International Corporation announced an agreement with Atidot, a cloud-based SaaS provider of AI and machine learning solutions for life and annuity insurers. The partnership facilitates new ways for North American and European insurers to generate revenue through analytics and actionable insights. The joint solution empowers life and annuity insurers to maximize the value they gain from their books of business. The solution produces actionable insights enabling better service for policyholders and new revenue generation as it is integrated with Sapiens CoreSuite for Life Insurance, Sapiens IllustrationPro, as well as Sapiens’ analytics and digital offering. “Sapiens constantly aims to mine…