The Insurtech Israel News is proud to present the Israeli delegation to the ITC convention – the world’s largest insurtech event, that will take place at October 2021 in Vegas.

this year is the most Global Insurtech Gathering of Insurance Leaders with more than 30,000 attended participants from more than a 100 countries.

ITC Vegas is the world’s largest Insurtech event – offering unparalleled access to the most comprehensive and global gathering of tech entrepreneurs, investors, and insurance industry incumbents.

Over the course of three days, the industry will convene to showcase new innovations, to learn how to increase productivity and reduce costs, and ultimately to enrich the lives of policyholders. The superlative networking, with tens of thousands of meetings, is one of the hallmarks of an ITC event.

Toonimo

Dan Kotlicki

Name of the founders:

Dan Kotlicki

What is your product?

Toonimo is an enterprise grade Digital Adoption Platform that provides step-by-step personalized interactive web guidance, using patented voice, visual cues and text bubbles, to achieve the ultimate online self-service experience.

What problem are you trying to solve?

Toonimo helps onboard users onto complex web portals with its innovative step-by-step guidance technology. Toonimo is also utilized for conversion oriented funnels and customer support reduction use-cases.

What is the current status of your business?

Toonimo is serving global enterprises across multiple industries such as Insurance, Financial Services, Telecommunication, Pharmaceuticals, Defense, Banking and more. Toonimo has 2 patents, additional patent pending and will continues to innovate in the Digital Adoption space.

What are your goals from the ITC convention?

Toonimo is looking to expand its reach with additional potential partners, whether directly or through business partners.

What is one other thing you’d want your readers to know about you that will make you stand out?

Toonimo is introducing a patented Voice-Bot technology that will in my opinion change the way individuals interact with the web and apps. The technology enables conversational voice interaction over the web that incorporates another sense while browsing. Imagine for example you enter your Telco provider from your mobile device, you click on a button that asks you “How can I Help?”, you reply with speech by saying “I want a mobile plan”, then the bot agent replies back “Do you already have a plan with us or are you looking to join us?”, and it continues having a human-like conversation with follow-up questions until the software can redirect you to the area of need and from there guide you on the rest of the process with our core patented audio-visual technology.

OpenLegacy

from left to right: Romi Stein, CEO and Co-founder and Roi Mor, CTO and Co-founder

Name of the founders:

Romi Stein, CEO and Co-founder and Roi Mor, CTO and Co-founder

What is your product?

OpenLegacy’s digital modernization platform enables organizations with legacy systems to release new digital services faster and easier than ever before. Connecting directly to even the most complex core systems, OpenLegacy automatically generates the digital-ready components needed to integrate legacy assets into exciting new innovations.

What problem are you trying to solve?

Companies across industries must keep up with rapidly changing consumer needs in order to survive. But digital innovation is especially challenging for organizations with monolithic core systems and applications. OpenLegacy has long focused on the insurance industry, enabling enterprises to digitally innovate as they once had decades ago.

What is the current status of your business?

In 2021, we introduced our most significant offering yet: the Hub. With Hub, enterprises can create reusable, language-agnostic integration assets – ensuring that teams can focus on core business functions and deploy digital applications faster than ever before.

With our expanded offering, we expect to announce more Fortune 500 companies later this year, adding to our strong customer base which include the likes of Liberty Mutual and AIG.

What are your goals from the ITC convention?

Our ultimate goal is to prove that insurance enterprises can align cost reduction and increased productivity – goals often thought to only profit companies – to benefit in parallel with their customers.

What is one other thing you’d want your readers to know about you that will make you stand out?

The cloud computing revolution has created the potential for truly life-changing innovation. But insurance, an industry with the biggest reach and largest installed customer base, struggles to deliver this innovation. OpenLegacy’s approach to modernization is radically different and effective compared to that of traditional digital transformation platforms, and we have proof to back it up.

EasySend

![]()

![]()

Name of the founders:

Tal Daskal – CEO & Co-Founder, Omer Shirazi – COO and Co-Founder and Eran Shirazi – CTO and Co-Founder.

What is your product?

EasySend is a no-code development platform for building and optimizing digital customer journeys in insurance, banking, and financial services in order to cut costs, increase revenue and improve customer satisfaction.

What problem are you trying to solve?

EasySend was founded by three Financial and Tech industry veterans who experienced first-hand the adverse effects of clunky paperwork-based processes and decided to do something about it. That is how EasySend was born – a no-code development platform for building and optimizing digital customer journeys in insurance, banking, and financial services.

What is the current status of your business?

EasySend is a fast growing startup, headquartered in Tel Aviv, Israel with almost 100 employees. EasySend caters to the insurance, banking and financial industries throughout the United States and Europe, and has customers with some of the leading financial companies such as VGM, Cincinnati Insurance and Real Garant.

What are your goals from the ITC convention?

EasySend is excited to be attending the ITC convention and share the success of the digital transformation revolution within the insurance industry, especially since the start of the COVID-19 pandemic. EaySend would also like to build brand awareness and recognition within the insurance industry throughout the United States.

What is one other thing you’d want your readers to know about you that will make you stand out?

Learn how EasySend can turn your 5-year digital transformation plan into only a few weeks through its customer journey, no-code platform.

Digital Owl

from left to right: Yuval Man, CEO and Amit Man, CTO

Name of the founders:

Yuval Man, CEO

Amit Man, CTO

What is your product?

DigitalOwl uses advanced technology for faster medical records review, delivering increased productivity and a competitive edge.

What problem are you trying to solve?

MANUALLY REVIEWING MEDICAL RECORDS IS EXPENSIVE!

Manually reviewing medical records at scale is a huge drain on resources.

- Time-consuming

- Labor-intense

- Tedious, monotonous

- Error-prone

Cost challenges are amplified when highly skilled workers spend hours sorting through medical records.Human review of medical records is not accurate enough, and essential information is often missed. Computers don’t get bored or tired, and they extract more meaningful medical information in

a significantly shorter time.

Humans missed medical findings such as blood clot, hypertension, laparotomy, loss of consciousness, disc herniation, biopsy, smoker & more. But, this is to be expected. Reviewing hundreds or thousands of pages of medical information is extremely tiring and challenging, even for trained professionals.

Underwriters, Claim Analysts, and Clinical Experts are good at making decisions. But decision-making is often only as good as the information we have.

What is the current status of your business?

DigitalOwl operates in the US and Israel, helping Life, Disability, Accident, W/C, and BI carriers in the underwriting and claims analysis process.

What are your goals from the ITC convention?

We would love to meet claims and underwriting teams (Life, Disability, W/C, CI, GL, LTD) to show them the DigitalOwl solution in action.

Futura Genetics

Efi Binder

Name of the founders:

Efi Binder and Ram Warsha

What is your product?

Futura Life – A digital health platform powered by genomics designed for life insurance clients. Our solution is 100% compliant. We are the regulatory firewall that allows insurers to harness the power of genomics for the first time in history.

What problem are you trying to solve?

Insurers today are looking for ways to influence clients’ health and interact with them post-underwriting. We allow insurers to benefit from genomics data in a regulatory compliant way to extend the life expectancy of their clients.

What is the current status of your business?

We raised a pre-seed round of ~$1M and currently working with our design partner AIG.

Later this year, we will expand our service into the US with a few selected life insurance companies.

What are your goals from the ITC convention?

Showcase our system and unique offering to players in the industry.

Choose another 2-3 Life insurance companies in different geographical areas in the US to work with.

What is one other thing you’d want your readers to know about you that will make you stand out?

If combining genetics and insurance is not unique enough to stand out, I would say that Futura Genetics, was founded by ex-military, security is more than a phrase for us. It’s fundamental.

Joshu

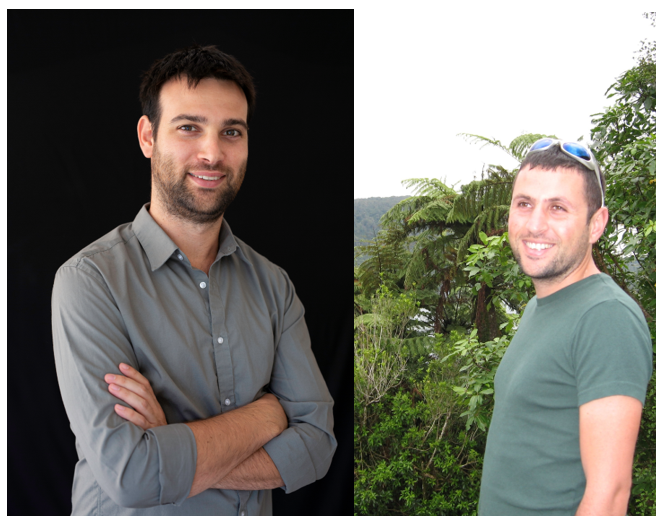

Left: Roy Mill, CEO & Co-Founder and Shimi Bornstein CTO & Co-Founder

Name of the founders:

Roy Mill and Shimi Bornstein

What is your product?

Joshu is a platform that allows insurance professionals to spin up portals and APIs that sell and underwrite automatically without coding or long implementation processes.

What problem are you trying to solve?

The long and painful process of developing insurance products or connecting them to modern digital distribution channels.

What is the current status of your business?

We raised a Seed round last November and we’re working with several clients in beta.

What are your goals from the ITC convention?

We’re looking to find more clients and use cases to join us.

What is one other thing you’d want your readers to know about you that will make you stand out?

We’re an commercial insurance-specific solution, not a generic platform that works for insurance among other industries. With the right balance between tech and insurance expertise we make a perfect partner for any insurance company that wants to be as slick and modern as the newest insuretechs.

Ravin AI

Left: Eliron Ekstein & Dr. Roman Sandler

Name of the founders:

Eliron Ekstein & Dr. Roman Sandler

What is your product?

Vehicle inspection solution that utilizes artificial intelligence and computer vision, and can be delivered via a web application or via stationary cameras. The app automatically scans, captures, and monitors a vehicle while generating a 360° condition report.

What problem are you trying to solve?

The process of filing a car claim can be long, tiring, costly, subjective, and overall frustrating.

What is the current status of your business?

4 years in operation, raised $25M and closed round A a few months ago.

What are your goals from the ITC convention? Furthering our partnerships with carriers, claim processing providers and other ecosystem players

What is one other thing you’d want your readers to know about you that will make you stand out?

We are a global company, currently recruiting, our solution can be used via a smartphone or CCTV cameras.

ContGuard

Yiftach Nativ & Eviatar Chone Hav-Ron

Name of the founders:

Yiftach Nativ & Eviatar Chone Hav-Ron.

What is your product?

Contguard is a technology company that has developed IoT-based technology and artificial intelligence solutions for monitoring and tracking goods in order to streamline the supply chain and minimize damage to goods in transit.

What problem are you trying to solve?

Problems monitoring goods in transit, Such as arrival time, moisture to the goods, theft damage, property damage (such as breakage / damage to the goods) and more. End to end management of goods in transit.

What is the current status of your business?

An active high-tech company.

What are your goals from the ITC convention?

Get to know the companies involved in supply chain management, the Contguard solution.

What is one other thing you’d want your readers to know about you that will make you stand out?

Contguards unique solution enables our client to make a huge leap into the future of managing goods in transit, by presenting an EZ to deploy product and platform

That present major benefits and clear value within the shortest time.

Contguards flexible offer, enables clients to enter the program with minimal investment and grow gradually as they need

Our unique Insurance deep cooperations with 3 of the world leading insurance companies, enables us to present deep insurance benefits improving stats for both the client and the insurar

CGI – our cutting edge dashboard present our clients with powerful EZ to manage tool that enebles to manage and mitigate risks regarding their goods and supply chain procedures/

Lightico

Name of the founders:

Zviki Ben Ishay, Justin Josh, Omri Braun

What is your product?

Digital Completion Cloud – We’re Here to Simplify Complex Customer Processes

What problem are you trying to solve?

Both businesses and their customers want the same thing: to get things done. But customer-facing processes that rely on partial, siloed and legacy solutions just don’t work. Lightico makes it easy to digitally complete entire processes with swipes and selfies so businesses and their customers can move forward fast.

What is the current status of your business?

Series B

What are your goals from the ITC convention?

To Build Brand Awareness, to identify opportunities and relevant use cases, to have meaningful meetings with prospective customers and existing customers.

What is one other thing you’d want your readers to know about you that will make you stand out?

With Lightico, entire policy sales, claims and renewal processes can be completed effortlessly in one session via the customer’s cell phone. Complete Customer Processes at The Speed of Lightico.

Air Doctor

Left: Yegor Kurbachev – VP R&D, Jenny Cohen Derfler – CEO, Efrat Sagi-Ofir – General Manager and Yam Derfler – Head of Innovation

Name of the founders:

Jenny Cohen Derfler – CEO

Efrat Sagi-Ofir – General Manager

Yegor Kurbachev – VP R&D

Yam Derfler – Head of Innovation

What is your product?

Air Doctor connects travelers to local private doctors when they fall ill abroad, preventing unnecessary, often frustrating, and potentially expensive hospital visits, and reducing pressure on emergency care

What problem are you trying to solve?

Air Doctor solves critical pain points for sick travelers as well as insurers and OTAs by improving the travelers’ customer journey and reducing costs for all involved.

What is the current status of your business?

Air Doctor is fully operational in 61 countries and has strategic partnerships with international insurers and OTAs such as Allianz, Amadeus, FBTO, De Goudse and more.

What are your goals from the ITC convention?

Our goals are to attract more partners to work with us in leading the future innovation of insurance and also attract investors to open a dialogue with us regarding investing in our Round B.

What is one other thing you’d want your readers to know about you that will make you stand out?

Since the beginning of the COVID pandemic, Air Doctor has lead the way in innovating better medical standards in the insurance industry. We have signed multiple partnerships with international insurers who understand the need to digitalize their offering in order to stay ahead of the game. With Air Doctor, insurers can provide a digitalized VIP offering while reducing costs guaranteed.

Binah.ai

Left: Konstantin Gedalin, Michael Markzon and David Maman

Name of the founders:

David Maman,

Konstantin Gedalin,

Michael Markzon

What is your product?

Binah.ai’s health data platform is a software-based solution that enables extraction of a rich variety of health parameters, including vital signs (heart rate, heart rate variability, oxygen saturation, respiration rate), mental stress, parasympathetic activity, pulse-respiration quotient (PRQ) and soon, blood pressure, all through a smartphone, tablet or laptop camera.

What problem are you trying to solve?

Problem –

Binah.ai aims to eliminate the friction associated with health monitoring wearables and equipment, which prevents countless individuals from improving health and obtaining wellness and contributes to lengthy, costly and at times, inaccurate insurance procedures. Friction includes cost, inconvenience, difficulty of use, added time, inaccuracy, maintenance, shipment, and upgrades.

Binah.ai’s solution accomplishes this by enabling insurers to remotely extract and collect client-provided, real-time health data through a digital platform designed for devices that most clients already possess, thereby allowing data to flow seamlessly from clients to insurer databases.

What is the current status of your business?

Binah.ai is currently in market growth stage, with increasing annual revenues.

What are your goals from the ITC convention?

At ITC 2021, Binah.ai seeks to further increase awareness of the many benefits of its solution among the global insurance community, and of course, to create business opportunities.

What is one other thing you’d want your readers to know about you that will make you stand out?

Binah.ai’s technology is currently in the process of receiving medical approval as a software-as-a-medical-device (SaMD) from several medical regulatory bodies worldwide, including the Food and Drug Administration (FDA) in the U.S., CE in Europe, and PMDA in Japan.

Binah.ai’s groundbreaking technology has achieved global awareness and market recognition such as the 2020 CES Innovation Award, 2020 NTT Global Grand Champion in the Open Innovation Contest, 2019 Gartner Cool Vendor and more.

Insurights

Insurights team

Name of the founders:

Guy Benjamin, Elad Ofir, Ben Nagar, Ben Goldenberg

What is your product?

We have developed Zoe, the only AI-powered virtual Chief Health Officer. Designed to provide employees with on-the-spot information and tools to answer specific health plan questions, share provider’s actual costs and much more. Zoe helps employers process the immense amount of data in their plans while identifying opportunities to manage cost. Companies can improve overall employee wellness and reduce cost not care.

What problem are you trying to solve?

employers spend $1.6T/year on employees health. The problem is that 2/3 of employees say they do not know what they are covered for.

What is the current status of your business?

We have a beta version that is already in used by a number of US companies, we are in discussions with health Insurance brokers, insurance providers, PEOs, etc.

What are your goals from the ITC convention?

We’re looking to connect with Health Insurance brokers and health insurance providers who are interested in harnessing Zoe to help improve their customer service, reduce in-calls, shorten call center interactions, improve users’ health and well-being, reduce turnover, improve sales, and provide an expectational user experience

What is one other thing you’d want your readers to know about you that will make you stand out?

Our mission is to make employees healthier by allowing them to access, understand, and utilize their health benefits. We are the only company that puts the employee in the center and have their best interest. We harness the most cutting edge technology to do this and have been seeing tremendous improvements in our user satisfaction, overall health, and engagement.

Urbanico

right: Yoni Levi and Yuval Shafrir

Name of the founders:

Yuval Shafrir and Yoni Levi.

What is your product?

Urbanico is building an urban intelligence platform, providing insurance carriers with hyper-localized urban data, adding contextual risk factors on top of the common rating schemas, currently used by the industry. Urbanico’s engine automatically analyzes billions of different urban data points, distills their fundamental building blocks and models their intrinsic relationships, building a coherent representation of the urban landscape that reveals its fundamental risks and opportunities, in a whole new level of granularity. Urbanico’s platform brings best-in-class data, plugged into the insurance value chain as contextual risk factors, that are based on external indicators, improving common actuarial models and helping insurers to refine risk selection and underwrite risks faster, with superior accuracy.

What problem are you trying to solve?

The insurance industry has always maintained a value chain that significantly relied on data. While insurance carriers are utilizing big data on scale for decades, their technological barriers withhold them from many external data sources that are critical in order to assess, select and underwrite risk properly, especially in the highly competitive environment we are seeing these days. Urbanico is bringing new contextual data sources that revolutionize the way the industry is looking, estimating and mitigating risk.

What is the current status of your business?

Urbanico’s 1st risk factor – uCrime is up and running and we are starting PoCs with some of the largest carriers in the US. Urbanico’s coherent urban data representation that is distilled into unified risk factors, is built under a plug-and-play API first integration practice, designed to seamlessly connect into carrier’s standard procedures of work. In addition, we are heavily working on additional risk factors, dealing with fire, infrastructural, flood, water leakage and many other highly important perils for the book of business of any insurance carrier out there.

What are your goals from the ITC convention?

Our main goal is to expose our value proposition to the US insurance community and help US carriers to go the extra mile in their risk engineering processes and build better, more personalized insurance products. We are obviously very excited meeting some of the top industry leaders that will take part in the conference, exchange ideas and learn from their experience and insights.

What is one other thing you’d want your readers to know about you that will make you stand out?

Urbanico’s platform is built with carriers in mind, making sure that we are bringing a revolutionary solution that’s at least 10x better than what’s currently available in the market. Eventually, we end up building a solution that brings 150X improvement from a spatial standpoint as well as daily update frequency instead of annual update frequency, and we are just getting started.