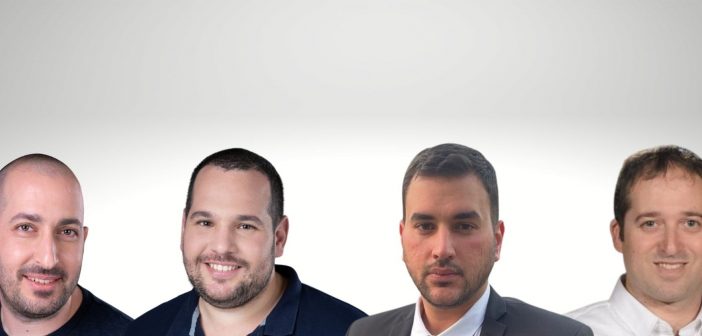

For any organization that needs to intake data and signatures from customers, EasySend is a no-code digital transformation solution that delivers an easy and quick way to transform complex forms into digital experiences so that they can automate their workflows, streamline customer interactions and ensure data accuracy. The key figures in the company are Tal Daskal, CEO & Co-Founder, Eran Shirazi, CTO & Co-Founder, Omer Shirazi, COO & Co-Founder and Gary Chan, VP, Head of North American Sales. What is the problem in the insurance sector that you are trying to solve? Easysend transforms any complex form or customer data…

Browsing: #featured

Sapiens International Corporation, a leading global provider of software solutions for the insurance industry, announced today an agreement to integrate Microsoft Azure OpenAI Service to harness the most advanced generative AI models and tools for the insurance industry. Sapiens will integrate Microsoft Azure OpenAI and Azure Power Virtual Agents to provide generative AI solutions for insurance companies, allowing customers to easily navigate complex documents such as policies, terms and conditions, and more, using natural large language AI models. Sapiens’ AI, cognitive services and process automation can empower insurers through the entire insurance value chain, to provide instant answers across multiple…

Travel insurance startup Faye today announced it has raised $10M in Series A funding just a year after launching its product in the U.S., bringing the company’s total funding to $18M. The round was led by Munich Re Ventures along with existing investors Viola Ventures and F2 Venture Capital. Additional investors include Menora Tech and Mike Nelson, former CEO of Global Travel Insurance at Allianz. Faye’s proactive and holistic travel insurance product has already delivered unmatched value for travelers embarking from the U.S., resulting in widespread adoption, consistent 5-star reviews and a significant number of customers already traveling with Faye…

In a move that resembles a vote of confidence for the start-up, Allianz Africa renewed its multi-year partnership with OKO. Allianz and OKO initially signed an agreement in 2019 to test OKO’s concept in Mali. OKO offered an affordable and automated climate insurance accessible for the first time via mobile phone to smallholder farmers. 4 years later it is the most popular crop insurance in Mali. OKO uses parametric insurance technology, meaning that insurance claims are automatically validated and paid if satellite data shows that the weather conditions were very detrimental to the agricultural activity. It covers events such as…

The Insurtech company, Lemonade, is expected to soon release tens of its employees, which represents less than 3% of the company’s total workforce, who are about to be laid off. Sources close to the company informed Insurtech Israel News that these actions aim to streamline the system’s performance and are not cutbacks as claimed in the media. Meanwhile, the company has sent hearing summonses to its employees, but these have not yet concluded, and as of today, the final number of layoffs remains unclear. Sources emphasize that these personnel reductions are not a result of financial difficulties; in fact, it…

Click-Ins Ltd is Pre underwriting check as a service. The car insurance industry relies mainly on traditional customer declaration to check for possible red flags that will cause problems during the underwriting process. Pre-underwriting requires good expertise, and not all have such expertise in-house. Click-Ins provides a revolutionary unique Pre underwriting check as a service, which means that process can be made faster, more standardized, and the solution will ensure that images are sent directly for inspection, helping insurance companies avoid fraud and gain the correct documentation. The key figures in the company are Doron Gohar, CEO , Dmitry Geyzersk,…

OpenLegacy offers a cloud-native hybrid integration platform. OpenLegacy Hub delivers a fast, simple, risk-free way to generate, extend and manage digital services from on-prem legacy and core systems to the cloud. It connects directly to nearly any core system without changing the underlying infrastructure, instantly generating microservice-based APIs in a low/no/full code way. Making the cloud journey not just possible but faster and more efficient than ever before, no matter the chosen strategy: modernizing in place (hybrid), rehosting/replatforming, or even replacing and rewriting the entire application. Each can be simplified and automated to optimize the process, drastically eliminating complexity, time,…

Atidot provides AI, predictive analytics solutions for life insurance and annuities companies. their cloud base platform enables carriers to gain an in-depth understanding of their policyholder, predict their behavior and provide them with the right product at the right time throughout their life journey. These solutions can generate up to 4X in premium potential and drive growth from new existing customers by 4X. The key figures in the company are Dror Katzav – Founder and CEO, Eyal Bar Noy – Vice President of Engineering, Sherry Chan – Chief Strategy Officer and Theresa Luty – VP of Sales. What is the…

YuviTal Health Named Top Israeli Insurtech for Second Year Running by Insurtech Israel and 50 most admired companies by the Silicon Review Empowering Healthier Living through Innovation. These recognitions underscores the company’s position as a cutting-edge leader in the insurtech space. At YuviTal Health, we are dedicated to providing the most innovative solutions to our insurance partners, enabling them to provide their policyholders with the most effective and easy-to-use tools for improving their health and well-being. Our latest features, including motion detection and smart bottles, are revolutionizing the industry, helping policyholders exercise more accurately and stay hydrated in the most…

FICX offers advanced CX solutions for customer service organizations working to optimize support and sales interactions while reducing costs. The FICX platform simplifies and accelerates the development of digital customer experiences that deflect and shorten live agent interactions while increasing satisfaction. Globally, FICX solutions transform tens of millions of customer service and sales experiences each month. What is the problem in the insurance sector that you are trying to solve? Great customer service helps insurance companies stand out and create competitive advantage. When insurance companies do a great job serving customer needs, they acquire more customers, retain customers longer, capture…