Surance.io has partnered with IDI Direct Insurance to create a personal cyber Insurance policy and an App called “Cyber Up”, which launched in cooperation with GDH TLV, a joint Innovation Insurtech HUB by IDI (ISR) & MSI (JAP). According to the company, This multi-layered cyber protection offers personal cyber insurance to individuals as well as families. The product provides risk prevention tools that help consumers protect themselves and their electronic devices against cyber-attacks. It also provides them with compensation and 24/7 support in case of a cyber-attack and advanced smart home risk mitigation service. Considering this launch, Surance.io has accelerated…

Browsing: #featured

MPCheck’s medical underwriting services have been successfully launched at Migdal after collaborating with Clal Insurance Group. The company is expected to add more insurers to its list in the near future. MPCheck’s solution harnesses cutting-edge technologies that streamline the underwriting process and offer advanced medical examinations that can be conducted at the convenience of insured customers in their homes. Nitzan Lahat, the CEO and founder of MPCheck, expressed his excitement about providing advanced services to customers of these insurance companies. He further noted that all stakeholders, including agents, insured customers, and insurers, have expressed high satisfaction with their innovative services.…

Polywizz, an insurtech company specializing in advanced technologies for insurance document and policy analysis, has announced the launch of its new service, POLYMAX. This service enables insurance agents to view all relevant customer data in one place, including Har HaBituach, Pension Swiftness, and policy copies from insurance companies. While collecting information is relatively simple, analyzing the data and extracting insights that increase sales can be a time-consuming task. That’s where POLYMAX comes in. The report offers a comprehensive view of all relevant customer data, including policy copies, and uses OCR and AI technologies to provide insights and recommendations to the…

The holding company TLV Capital, headed by Mr. Uri Shmueli, is adding to its investment portfolio Trusty, a digital insurance comparison platform through insurance agents managed by Eyal Schwartz Trusty is an Insurtech start-up, developing a new digital distribution channel for insurance brokers/companies and consumers by operating a unique MARKETPLACE and Price Comparison platform. The entry of TLV Capital as a partner to Trusty reflects the group’s expertise and extensive experience in managing companies in the segments of financial services, technology, project management and consulting, in Israel and Europe. Trusty was founded by Eyal Schwartz, the company’s CEO and senior executive…

Over 40,000 new vehicles enter Haifa Port annually; Ravin’s technology will continuously verify the physical integrity of the vehicles until they are loaded onto transport vehicles, minimizing risk and reducing financial exposure for Haifa Port Ravin AI, a leader in AI-powered visual inspection across the fleet, rental, used car and insurance industries, announced today its partnership with Haifa Port, Israel’s largest port, in implementing Ravin’s Inspect, Autoscan and Eye tools to visually inspect new vehicles entering the country to pinpoint any damage done to vehicles during the transport, offloading and storage process. With the marine transportation market for new vehicles…

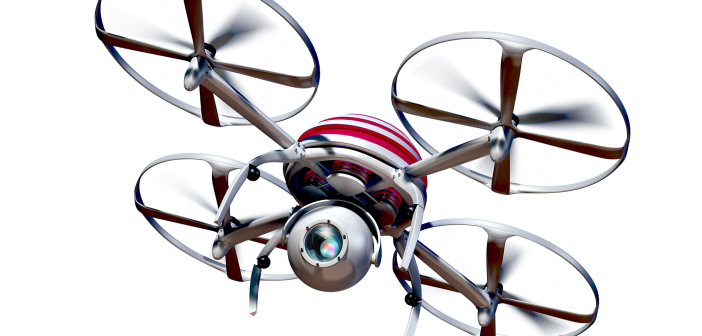

SkyWatch Insurance Services, provider of usage-based insurance for drones, cars, and motorcycles, announced its fully digital, customizable light aircraft owner’s insurance platform. Backed by insurance and aviation risk management solution company Global Aerospace, SkyWatch says its newest offering will expedite the process of customizing and obtaining insurance coverage for aircraft owners by cutting out the need for a middleman and providing an end-to-end digitized quote and purchase experience. Last year, SkyWatch launched its on-demand aircraft renter’s insurance that allowed pilots the ability to customize their aircraft renter’s insurance policy based on the amount of time they plan to be in the…

The new report from Parametrix reveals the details of cloud downtime in 2022 among the three major providers – Amazon Web Services, Google Cloud, and Microsoft Azure. The report is based on observations recorded by the Parametrix Cloud Monitoring System. In a recent survey by Parametrix 95% of corporate decision-makers said their business is dependent on the cloud. Nearly half said the cloud is a mission-critical service. Because of the cloud’s enormous new importance in the digital supply chain, the cloud economy is growing at an unprecedented rate. Worldwide end-user spending on public cloud services is expected to reach $591.9.8…

According to the company Aircraft Owners can now customize their coverage without any human interaction, saving them valuable time and money. SkyWatch: “Our platform provides a hassle-free insurance experience, allowing you to fly with peace of mind”.

The Israeli Insurtech Accelerator 5th cohort is officially open. The first day of the accelerator and opening event was held at Aon Reinsurance Israel, including an excellent workshop that the Aon team conducted. Dozens of great startups have applied to the program, startups with amazing solutions for the insurance world in Life, Health, Cyber, P&C, and more but just 6 startups have been selected to join our unique program. Blue Cape – provides highly accurate real-time and historical data on the risk from respiratory diseases to the L&H Insurance Industry in order to help them improve the performance of their…

Battery Ventures leads Series B as commercial traction validates the demand for an AI-powered fleet insurance option that rewardssafer driving with savings AI-powered commercial auto insurance company Fairmatic today announced it has raised $46 million in new funding, six months after its oversubscribed Series A, bringing its total financing to $88 million. Battery Ventures led the round with participation from current investors and Bridge Bank. Fairmatic is creating a new commercial auto insurance category with its AI-driven underwriting approach that unlocks continuous savings opportunities for fleets. By providing an easy way to monitor driving events and offering actionable improvement tips, Fairmatic is giving…