Levitan, Sharon a leading Israeli law firm in the area of Insurance and Reinsurance joined together with Clyde & Co, a leading global law firm, which specializes in insurance, transport, infrastructure, energy, and trade and commodities, to offer services in the Insurtech area. At a reception at Clyde & Co’s office which took place on 14 March 2022, Clyde & Co hosted a delegation of startups, members of the Israeli Insurtech Accelerator headed by Kobi Bendelak. The reception guests included members of the insurance industry, lawyers from Clyde & Co and Levitan, Sharon and a range of people who are…

Browsing: #featured

The last couple of years transformed the insurance industry as much as any other service-orientated sector. As CEO of the only born-in-the-cloud, data-driven platform for brokers, agents, and MGAs, I wanted to share three trends we believe will drive digital transformation through 2022 and beyond. Hybrid working. According to Accenture’s Future of Work Study 2021[1], 83% of global workers surveyed said they prefer a hybrid model over remote working at least 25% of the time. The survey also shows that 63% of high-revenue growth companies have already enabled hybrid models. As of 2020, remote working method proved its effectiveness. However, some companies are concerned about the home-working…

Vesttoo, a leading AI-based insurance-linked investment platform, today announced the global expansion of its leadership team to include key industry veterans who will manage the company’s offices in London, Seoul, as well as Dubai. The seasoned executives include the former CEO of Allianz Global Corporate and Specialty UK, former CEO of AIG Korea, and a former high-ranking manager at Investbridge Capital. They will oversee Vesttoo’s market penetration in Europe, Asia, and the Emirates, and will be instrumental in reaching the company’s $7bn capacity target. “Our number one focus is to create diversified insurance-linked investment options with multiple access points for investors…

Representatives from 103 organizations last week went on the stage of the East functions hall in Tel Aviv to receive excellence awards in the IT Awards competition – the People and Computers magazine’s computer excellence competition – for IT ventures carried out in the past year. Menorah Mivtachim received the “Champion of Champions” award in this year’s competition, having won a series of prizes in a range of categories, in respect of 31 projects, including the Cloud Customer 360 Picture, leads management in the Salesforce system, premiums and personal claims systems, self-development of 14 projects in the digital transformation category.…

Q&A with Gabi Peles, CEO at Puls What is the service that PULS offers? Peles: Puls is serving the dynamic needs of the modern homeowner keeping their home at its best by providing a wide array of quality, fast, and reliable home services delivered via a value-added home care and warranty plans. Puls tech-enabled platform provides local home repair technicians the work and software to build and grow a repair business and solve for a global shortage of skilled workforce. What Value does it provide? Peles: Forward looking protection for home systems as well As access to same or…

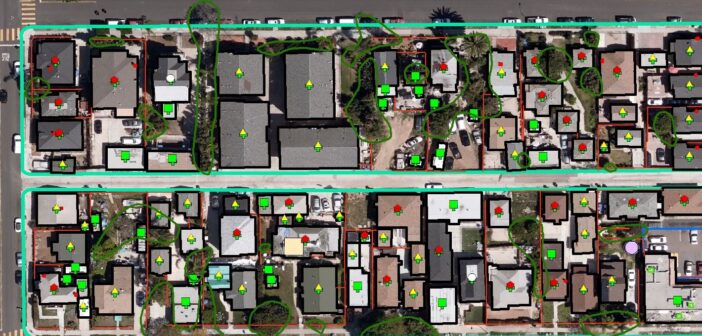

GeoX, a leader in supplying geospatial data to insurers, has partnered with Sompo Holdings Inc., Sompo Japan Insurance Inc., and Sompo Risk Management Inc., specialty providers of property and casualty insurance and reinsurance with operations in the U.S. and 80,000 employees in 228 cities in 30 countries. This partnership will support Sompo Japan as it develops an automated underwriting methodology utilizing state-of-the-art AI technology. In recent years, advances in geospatial data technologies such as higher resolution and 3D satellite imagery have led insurers to use data in ways they had not previously considered. By combining GeoX’s ground-breaking technology with Sompo’s…

Clal Insurance is expanding its home insurance policy to include cyber insurance for the family as part of it, at a special price. Home insurance offers a policy which is tailored to the customers’ needs, with a variety of options: structure insurance, contents insurance, expanded third party coverage, earthquakes, coverage for jewelry and many other additional coverages. The option of adding cyber insurance for the entire family in now being offered. The family cyber insurance offered by Clal Insurance and Finance gives a coverage envelope protecting against a wide range of cyber events, including net shaming and bullying, recovery of…

Rita Baal-Tacsa, a senior figure in the insurance sector, who serves as an Ayalon director and former VP at the Phoenix and also represented the Marsh insurance broker in Israel, has been appointed as VP at the Vesttoo insurtech company. Rita is responsible at Vesttoo for partnerships with insurance markets and works for the benefit of insurers, reinsurers and underwriting agencies worldwide in need of capacity support for their ongoing activity. The company operates in the area of ART (Alternative Risk Transfer). Vesttoo has developed a unique algorithm and a digital platform that uses artificial intelligence (AI) for transferring risks.…

A successful collaboration between Menora Mivtachim and the Israeli startup, Hour One. Hour one has developed a platform for the creation of videos led by computerized and realistic avatars. Hour One’s unique video creation platform uses artificial intelligence and allows companies to take any person and turn them into a “synthetic figure” through a short computer scan. Then, the system allows its users to dictate to the character the desired text and produce realistic videos in minutes. Menora Mivtachim will continue to reach out to the local ecosystem and startups from around the world and explore new technologies to find creative and…

Vesttoo, a AI-based global alternative risk transfer and investment platform, announced today the launch of VESCOR, a strategic partnership with Corinthian Re, that will offer the world’s first non-catastrophe insurance investment-grade rated feeder fund. The new partnership will offer institutional investors rated notes securitizing dozens of underlying P&C reinsurance transactions. The first note issued will cover over $250 million in Gross Written Premiums (GWP), with an aim of covering $2 billion GWP in subsequently issued notes. The partnership is targeting its initial investment-grade rating for issued notes by one of the world’s leading rating agencies. Vesttoo launches VESCOR and first non-catastrophe P&C investment grade…