Q&A with Tal Rubenczyk, Treepodia CEO * What does Treepodia do? Rubenczyk: We enhance customers communication using AI powered videos. * What is the value for an insurance company? Rubenczyk: Insurance companies manage complicated communication with their clients using personalized videos. * What is the main problem in the insurance industry that treepodia is trying to solve? Rubenczyk: Being perceived as complicated, not clear, sometimes it is related to things we prefer not to think of (getting old, being in a trouble). Moving to video medium is a game changer for them. * What kind of videos have you produced…

Browsing: #featured

Policy and PIL Conversation with Munich Re Israel representative Dikla Wagner on discovering start-ups and innovation Dikla Wagner is on the hunt for new technologies. As Munich Re’s head of tech scouting in Israel, she seeks our new technologies that can be put to immediate use by Munich Re, its subsidiaries and its clients – insurance companies. She is also looking for something else: disruptive technologies – some kind of innovation that will change the trajectory of the industry for years to come. That is no easy task, and so Wagner meets with hundreds of Israeli startups each year, checking…

Assaf Wand, Hippo Co-founder and CEO: We set out to change the relationship between homeowners and home insurance Hippo, the Israeli high-growth insurtech group that’s transforming home insurance, closed $150 million in Series E funding, valuing its business at $1.5 billion post-financing. Hippo’s innovative home insurance model includes world-class customer experience and services that proactively identify and help to resolve risks for its consumers. In the past 12 months, the company has grown its total written premiums to $270 million, growing at 140 percent YoY. Hippo welcomed FinTLV, Ribbit Capital, Dragoneer and Innovius Capital as new investors in the oversubscribed…

Q&A with Dr. Oren Fuerst, Onlife co-founder What does Onlife do? Fuerst: We combine in a unique way Online Term life insurance underwriting and policy issuance along with ongoing digital healthy lifestyle and behavior economics tools. That enables long term and deeper interaction with the clients, reducing risk asymmetry and hence pricing, while improving profitability. What population are you approaching? Fuerst: We are focused on people that either have or are at high risk of developing chronic illnesses, and in particular those with metabolic syndrome (including pre diabetes, diabetes and others). How can you know if the insured is getting…

Q&A with Shira Warshavski, VP Marketing at Atidot. What does Atidot Do? Warshavski: Atidot is a leader in predictive analytics, artificial intelligence and machine learning solutions for the Life and Annuity insurance industry. Founded by a team of data scientists and veteran actuaries, Atidot offers a cloud-based software platform that provides data-driven insights to inform decision making, drive new business strategies, and create new revenue streams. The company has offices in the US, UK and Israel and was listed in the InsurTech100 Companies for 3 consecutive years by the research firm FinTech Global. In 2019 the company won a Gartner…

Q&A with Tal Berzon, digital transformation manager at Berzon Daimond insurance agency Tell me about Berzon’s digital Business. Berzon: After approximately 2 years long period of preparations which included: build-up of internet tech platform online process crystallization insurance documentation online premium payment collection integration of all this into one user friendly online system confirmation by regulation In September 2019 we launched our On Line specialized Private Jewellery insurance activity which is now fully operational with steady inflow of online clients. We keep developing our digital business including upgrade of the system and extending it to additional geographical areas as well as…

Q&A with Dr. Elad Ofir, Insurights CEO What does Insurights do? Ofir: Insurights is a user friendly & user specific Optimized Health Coverage Solution for health insurance vendors (Insurance companies & brokers) allowing more simple & dependable access to medical rights information. We help individuals be healthier by giving them a tool to understand and leverage their health insurance and wellness benefits. Not only we help to answer any health coverage related questions, we actually notify the user about relevant health covered procedures (e.g., annual physical exams, flu shots). Important to mention that Insurights’ platform provides answers and information based…

Q&A with Ido Peleg, Facetrom founder and CEO “Facetrom helps 2.9 Billion unbanked people in the world to get services from financial and insurance companies” – says Ido Peleg, Facetrom founder and CEO. According to him, 2.9B people in the world can’t get services and promote their lives because the companies are concern these people will do a criminal activity or expand their claims. Peleg: “Facetrom goal is to help the world and the Unbanked people. By using Facetrom, unbanked people can get services without sharing any personal data such as ID number, phone number, name and any other detail…

Q&A with Tomer Kashi, VOOM co-founder and CEO What does VOOM do? Kashi: VOOM is an Insurtech startup that provides innovative, usage based insurance solutions for the mobility space. VOOM partners with insurers to help them create new products and bridge the gap between their current solutions to today’s customers’ expectations and needs. What advantages do you have over insurance companies in developing Insurance products? Kashi: VOOM developed a unique Usage-Based Insurance platform, supported by a combination of a powerful AI-based risk analysis engine, proprietary born-in-the-cloud policy admin system and an effective API based distribution. This platform gives us several…

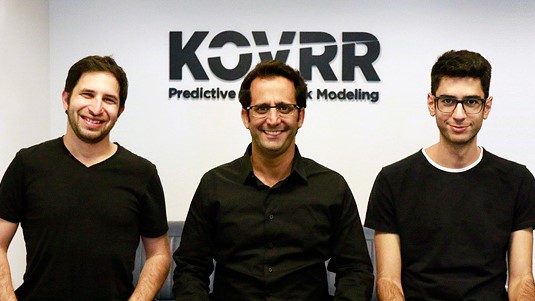

MAPFRE RE aims to leverage Kovrr’s portfolio management solution for analyzing accumulated cyber risk exposure in cyber (re)insurance treaties. MAPFRE RE, the reinsurance unit of MAPFRE Group, a global insurance and reinsurance provider, today announced that it is collaborating with Kovrr, a cyber risk modeling company to advance their capabilities for assessing accumulated cyber risk exposure in their treaties. Kovrr’s portfolio management is the first solution to introduce advanced machine learning sampling technology which creates representational synthetic portfolios when information regarding treaty risk composition is limited. The solution allows (re)insurers to financially quantify cyber risk for facultative books and treaties.…