By Dr. Upendra Belhe, President, Belhe analytics advisory and Guy Attar, Co-founder & Executive Chairman, GEOX Property and casualty (P&C) insurance represents $1.6 trillion in premiums (about one-third of the insurance industry). Industry reports state that the Homeowners’ Insurance segment alone is $105.7bn in 2020. The insurance industry is evolving. Property and casualty insurance now benefit from risk models that analyze huge and diverse data sets. New data source influencers are emerging in the insurance industry, with the hope to provide the most comprehensive and accurate assessment of a property. Comprehensive address, parcel and building information; current and historical owners,…

Browsing: #featured

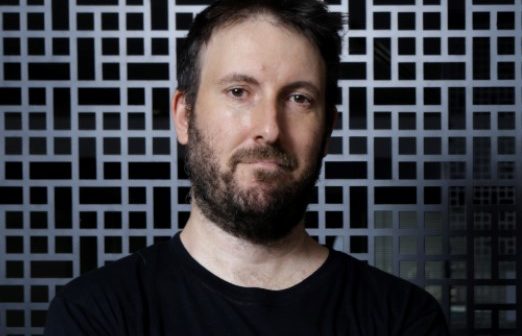

Q&A with Gil Or, Whatsper CEO What does whatsper do? Or: Whatsper provides a wide solution for businesses seeking to connect and interact with their customers via Whatsapp. We have developed a technology to handle incoming chats, our smart and intuitive bot provides the initial response and our proprietary Whatsper Inbox will allow multiple agents and departments to communicate. What are the benefits of using whatsapp as a marketing system over SMS, mail and other channels? Or: Whatsapp open rate is above 90% in most countries. If you want to get your customer attention, whatsapp is the way.…

Tel-Aviv based startup, Serenus.AI won 1st place of MTL Tech Awards 2020, a leading innovation event in Canada by Printemps numérique. Chosen out of hundreds of startups from across the globe, Serenus.AI won first place, by the public and the jury among them representatives from international companies such as Deloitte, and OVHcloud. The Serenus.AI™ (Patent Pending) system is an artificial intelligence-based platform developed to assist medical professionals, insurers and patients with their medical treatment decisions, providing the right treatment for the right patient at minimum time. This innovative cloud-based platform uses unique algorithms that replicate the objective decision-making process of top physicians.…

Q&A with Andres Kukawka, Founder & CEO/CTO at Otorize What does Otorize do? Kukawka: Otorize is a simple app that can detect impairment in seconds. It is NOT intrusive, NOT biological, NOT chemical, it does NOT use membranes or filters and there is NO need for maintenance. Being a cognitive test, 100% digital, IT IS effective in detecting impairment caused by any substance: alcohol, cannabis, drugs, and more. Otorize is a Health and Safety solution in the Workplace Safety and Transportation Safety verticals. The Recreational Cannabis regulation of the last few years challenges the current paradigm of measuring substance…

Q&A With Ronnen Fischer, Insurtix CEO What is Insurtix? Fischer: Insurtix is a modular breakthrough digital core layer for insurance. Who is it built for? Insurers or MGA’s? Fischer: Insurtix is targeted to any insurance activity such as Insurers and MGA’s. It was built as a suite of modules creating up to a full core platform – from policy administration system with underwriting capabilities up to a full core system handling claims, collection and more. It was planned to cooperate and easily integrate with third party systems such as CRM , Accounting systems and even existing legacy core platforms. What insurance companies…

Q&A with Eliron Ekstein, Co-Founder & CEO at Ravin What does Ravin do? Ekstein: Ravin’s artificial intelligence inspects vehicle condition to enable faster motor claim processing. Shortly after the incident, any user (including the claimant) can scan their vehicle using their mobile phone and receive a full 360-degree documentation of the vehicle’s condition, triaging of the claim to ‘light repair’ or more complex one, and breakdown of damages. How do you see the regular Claim experience for the insured? Ekstein: Despite attempts to digitize the claim submission, the process typically turns manual with phone calls and human estimations. Not…

Q&A with Effi Mor, Remitrix CEO What does RemitRix do? Mor: RemitRix provides insurers with web-based SaaS application to optimize their balance sheet management under Solvency II and IFRS17. What are the solutions you provide for you customers? Mor: Solvency II & IFRS17 engine with reporting tool, ALM, financial risk management, actuarial modeling, ML modeling for actuaries. What are the values that RemitRix offer to the market? Mor: Actuarial work automation, improved predictions accuracy, capital and balance sheet management optimization, Holistic solution. How can technology and machine learning improve the risk management of insurance companies? Mor: Better utilize data for…

Life insurance margins continue to be squeezed due to the plunging interest rates, as well as the precipitous drop in the stock market and global economic crises. The much-awaited rise in interest rates has not materialized, and recent events such as COVID 19 and high unemployment rates make it clear that they will continue to plunge. As a result, it is crucial for life insurance providers to find new ways to maximize the revenue opportunities available to them, such as locating current policyholders who possess the potential for substantial upsell, and Next Gen customers that are looking for personalization, all…

GeoX, the innovator and patent owner in the use of Machine vision and Deep learning for providing the property data based on aerial imagery announced that it has appointed Dr. Upendra Belhe as their board advisor. “Upendra, one of the sharpest minds in insurance analytics, brings the length and depth of the use of data and analytics to aid our mission of accelerating the use of property imagery data in the P&C space worldwide,” said Izik Lavy, Chief Executive Officer of GeoX. Dr. Upendra Belhe leverages his 25+ years of experience in data and advanced analytics to advise businesses on…

Next Insurance, The Israeli insurtech company transforming small business insurance, has raised $250 million in Series D financing led by CapitalG, Alphabet’s independent growth fund, with participation from FinTLV, a global leading insurtech VC, and existing investor Munich RE. CapitalG Partner Sumiran Das will join the Next Insurance Board of Directors. Next Insurance has now raised $631 million to bring simple, affordable, and tailored insurance products to the American economy’s most important growth engine: small businesses and the self-employed. Next Insurance’s technology-first approach drives down costs by up to 30 percent when compared to traditional policies. Other examples of Next…